[ad_1]

Bitcoin (BTC) saw its second-worst year to date (YTD) in 2022 since launch — predicted to remain flat through 2023, according to Arcane Research (AR).

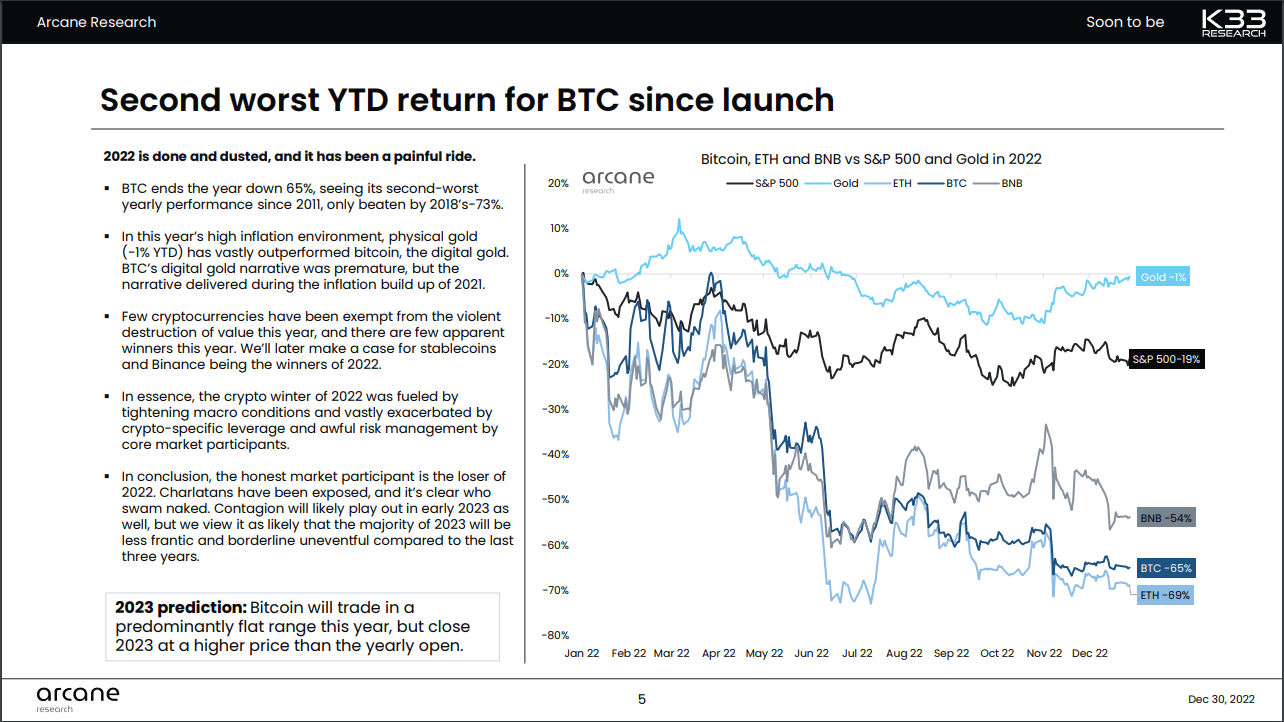

Down 65% by the end of 2022, BTC performed worse on only one other occasion — in 2018, down 73% on the YTD.

Compared to gold and S&P 500, cryptocurrencies took the biggest hit to value in 2022 — falling sharply in May 2022 and mid-June 2022, according to AR data.

“The crypto winter of 2022 was fueled by tightening macro conditions and vastly exacerbated by crypto-specific leverage and awful risk management by core market participants.”

AR said that — if reached in 2023 — the next BTC market bottom “will be the longest-lasting BTC drawdown ever.”

“2023 prediction: Bitcoin will trade in a predominantly flat range this year, but close 2023 at a higher price than the yearly open.”

After a year of central bank tightening, 2022 became “one big dollar trade,” as assets all became repriced while the dollar became more expensive, according to AR data.

“In 2022, the Federal Reserve’s effective funds rate grew from 0% to 4.25%, leading to a massive repricing of risk assets that all benefitted from easy money and a low-interest rate regime in late 2022 and throughout 2021.”

AR predicted that the Federal Reserve will hike interest rates throughout the first half of 2023.

[ad_2]

Source link