Author: e_cash_top

-

Bankrupt Genesis agrees to $21 million SEC fine over defunct Gemini Earn crypto lending violations

[ad_1] Bankrupt crypto lender Genesis Global has consented to a $21 million civil penalty tied to the now-defunct Gemini Earn lending initiative, according to a March 19 statement from the US SEC. Under the settlement terms, the SEC will not be paid the penalty until Genesis satisfies all bankruptcy claims, including those from Gemini Earn…

-

Institutions looks to deploy Bitcoin as liquidity to Lightning Network to earn yield

[ad_1] Bitcoin Lightning Network liquidity provider LQWD Technologies has partnered with Amboss Technologies to establish further institutional liquidity on Lightning. The collaboration positions LQWD to contribute liquidity to Amboss’s marketplace, enabling the fulfillment of market demand for Lightning Network liquidity while generating a yield on LQWD’s Bitcoin holdings. Amboss, a provider of data analytics solutions…

-

Bitcoin’s realized profit hits ATH but market keeps accumulating

[ad_1] Realized profit represents the cumulative profit of all Bitcoins moved on-chain, calculated as the difference between the acquisition and movement prices. It’s a direct measure of the profitability for Bitcoin holders, indicating when investors are likely to sell and take profits. On the other hand, the realized cap offers a more accurate representation of…

-

Solana Co-Founder Anatoly tells community to stop investing in memecoin pre-sales

[ad_1] Solana Labs Co-Founder Anatoly Yakovenko has seemingly taken a stand against Solana-based memecoins, calling for investors to “stop doing this” in relation to data showing the high volume of SOL being sent to memecoin pre-sale contracts. On-chain sleuth ZachXBT shared the image below detailing a list of social media accounts that had recently raised…

-

MicroStrategy invests $623 million in Bitcoin, now owns over 1% of global supply

[ad_1] Bitcoin development and Business intelligence firm MicroStrategy has bought more than 9,000 BTC for $623 million, according to a March 19 filing with the US Securities and Exchange Commission (SEC). According to the filing: “MicroStrategy acquired approximately 9,245 bitcoins for approximately $623.0 million in cash, using $592.3 million of proceeds from the Offering and…

-

Grayscale hints at lower fees for its Bitcoin ETF as market matures

[ad_1] Grayscale Bitcoin exchange-traded fund (GBTC) fees will gradually decrease as the market evolves, according to CEO Michael Sonnenshein. In a March 19 CNBC report, Sonnenshein pointed out that the fee reductions would align with market maturity, saying: “We have seen this in countless other exposures, countless other markets, you name it, where typically when…

-

100 sats would equal $1 if we repeat last cycle’s dollar demise

[ad_1] The inverse of the standard BTC/USD chart gives an interesting perspective on the rise in the purchasing power of Bitcoin over time. The USDT/BTC chart below highlights the dollar’s decline against Bitcoin since 2015. From its peak, the dollar has fallen 99.7% against Bitcoin. When viewed in this form, it’s hard to be bearish…

-

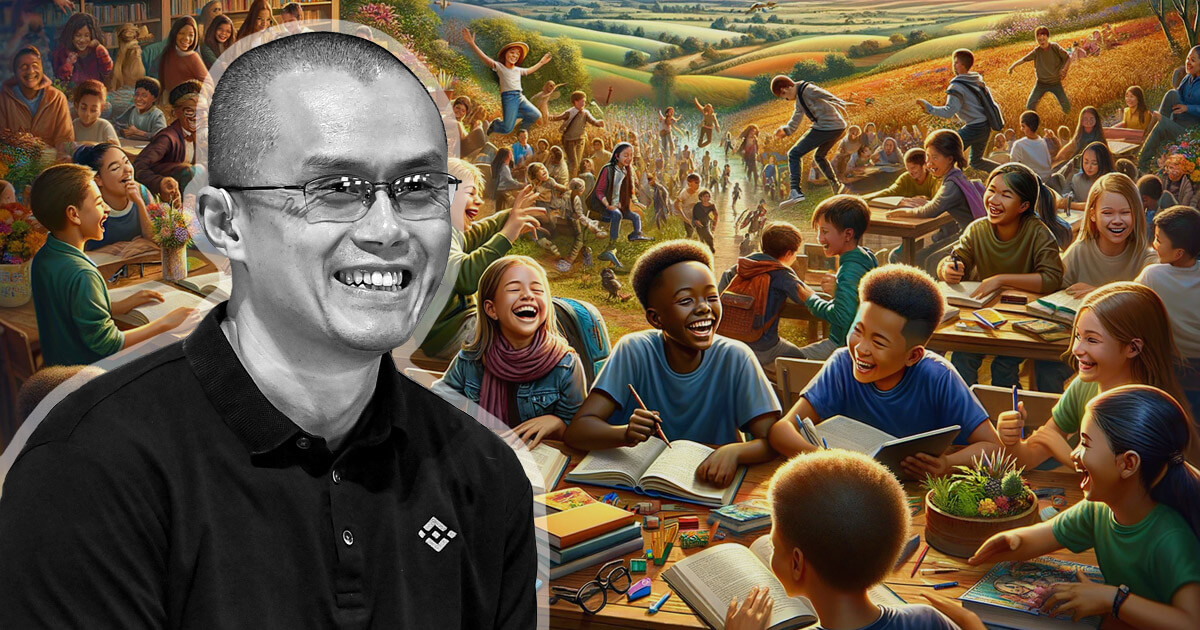

Binance co-founder Changpeng Zhao to launch Giggle Academy amid legal woes

[ad_1] Changpeng Zhao, the embattled co-founder of Binance, wants to launch a non-profit educational platform called Giggle Academy. Zhao had earlier hinted about the project in a cryptic March 18 post on X (formerly Twitter), where he wrote: “Launching a new project. No, no new tokens. Education project. More details soon.” What is Giggle Academy?…

-

Layer 2 labyrinth: Navigating scalability and decentralization

[ad_1] In the latest episode of the SlateCast, CryptoSlate welcomed Roy Hui, the founder of Pellar and LightLink, to discuss the role of enterprise and permissioned blockchains in the evolving world of Web3. Joined by Senior Editor Liam “Akiba” Wright and CryptoSlate CEO Nate Whitehill, the conversation delved into the unique value proposition of platforms…

-

No outflows for Bitcoin Newborn Nine ETFs as Grayscale forces $154 million net outflow

[ad_1] Bitcoin exchange-traded funds experienced a net outflow of $154 million on March 18, according to data from Bitmex Research. This marks the first outflow day since March 1, breaking a streak of consistent inflows. The outflow represents 2,229 BTC, based on the market reference rate. Grayscale’s GBTC product accounted for the entirety of the…