Author: e_cash_top

-

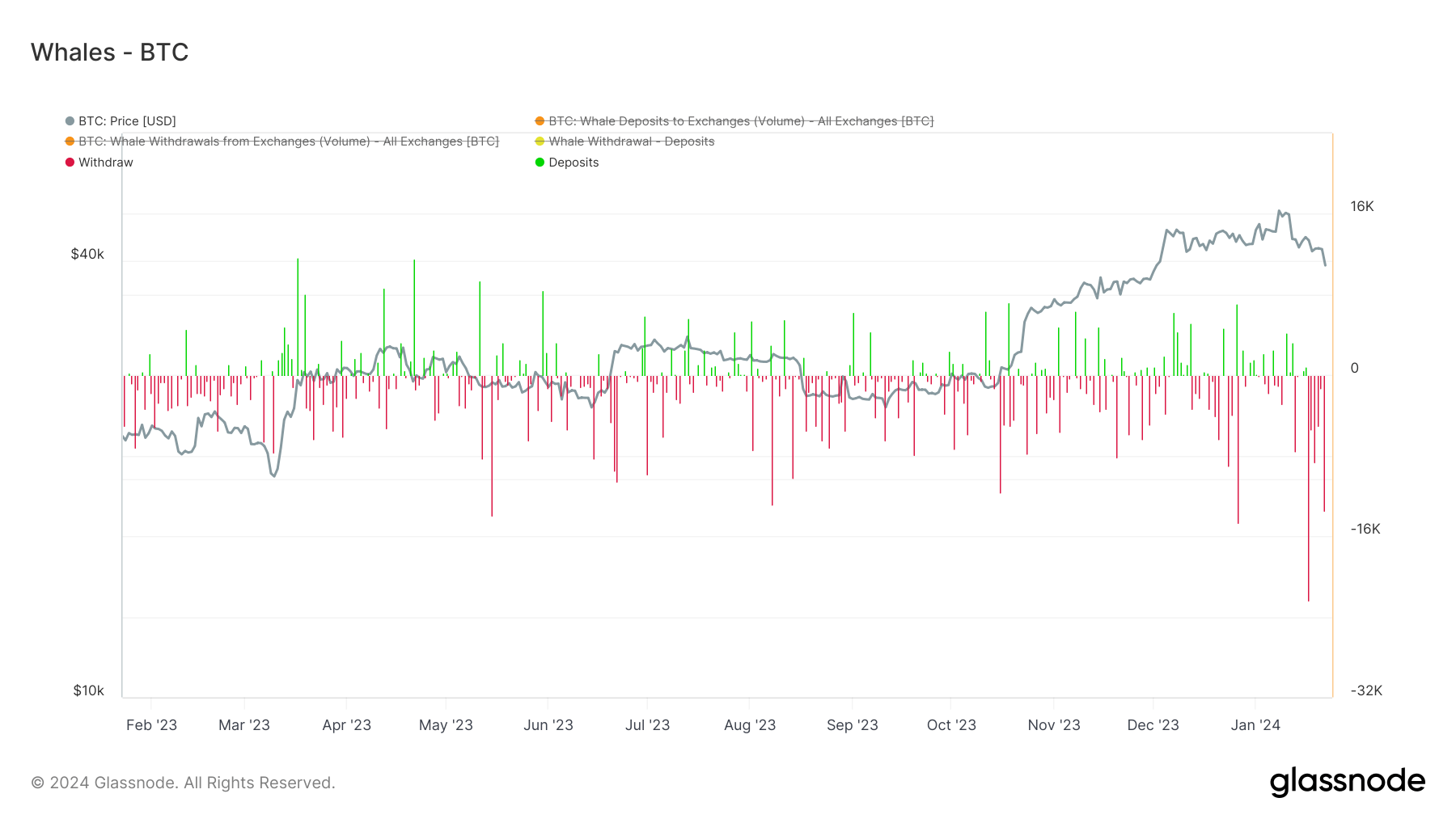

Surge in Bitcoin whale transactions defies market downturn

[ad_1] Quick Take The digital asset landscape is seeing a noteworthy surge in Bitcoin whale activity, as signaled by CryptoSlate’s recent data analysis. Amid a 20% pullback from Bitcoin’s highs, these whales – entities holding 1k BTC or more – appear to be capitalizing on the opportunity to accumulate. A marked uptick in activity reveals…

-

Understanding the differences in Bitcoin futures on Binance and CME

[ad_1] Open interest on Bitcoin futures listed on the Chicago Mercantile Exchange (CME) has been outpacing open interest on Binance futures since November 2023. As of Jan. 23, around 30% of the total open interest in the Bitcoin futures market is on CME. However, as spot Bitcoin ETFs begin to gain traction in the U.S.,…

-

SEC has a ‘hard no’ stance on spot Ethereum ETFs, but issuers are optimistic: FOX reporter

[ad_1] FOX Business reporter Eleanor Terrett reported a wide range of expectations regarding spot Ethereum ETF approvals on Jan. 23. Notably, Terrett suggested that the U.S. Securities and Exchange Commission (SEC) is opposed to approving a spot Ethereum ETF. She said: “Another source tells me the line at the SEC at this very moment is…

-

US lawmaker probing Meta’s involvement with digital assets, blockchain tech

[ad_1] Congresswoman Maxine Waters, ranking member of the Financial Services Committee, has initiated an investigation into Meta’s involvement with digital assets over financial stability concerns. Waters wrote a letter to top Meta executives Mark Zuckerberg and Javier Olivan on Jan. 22, highlighting a series of trademark applications that suggest a potential expansion into digital currency…

-

IRS adds cryptocurrency income tax question to four more tax forms

[ad_1] The IRS on Jan. 22 reminded all taxpayers to answer a question about digital assets and report all digital asset-related income. The question asks taxpayers: “At any time during 2023, did you: (a) receive (as a reward, award or payment for property or services); or (b) sell, exchange, or otherwise dispose of a digital…

-

BIS to focus on tokenization, CBDC as part of 2024 strategy

[ad_1] The Bank for International Settlements (BIS) has revealed its strategic priorities for 2024, with a particular emphasis on Central Bank Digital Currencies (CBDCs) and tokenization. The 2024 roadmap points to a continuation of the watchdog’s engagement with digital financial technologies. The BIS has taken a heavily pro-CBDC stance and has published a comprehensive framework…

-

Ethereum validators’ reliance on Geth sparks client diversity push by Coinbase

[ad_1] Coinbase, a leading cryptocurrency exchange, announced plans to diversify its execution clients amidst concerns over the dominance of go-Ethereum (Geth). In a Jan. 23 statement on the social media platform X (formerly Twitter), Coinbase Cloud disclosed ongoing evaluations to identify alternative qualified execution clients for its platform while acknowledging the growth being made in…

-

Why most Grayscale investors may remain in profit if GBTC falls further 20% to $27

[ad_1] According to data from trading firm Webull, around 70% of Grayscale GBTC holders likely remain in profit. The average shares were purchased at $27.82, some 20% below the current price as of press time. The Webull data shows the state of the trust the day before its conversion to a spot Bitcoin ETF and…

-

Coinbase’s Base leverages Chainlink technology to enhance developer capabilities

[ad_1] Ethereum layer 2 network Base has successfully integrated Chainlink Automation to enhance the scalability of smart contracts, according to a Jan. 23 statement provided to CryptoSlate. This integration would allow Base developers access to decentralized, verifiable, and gas-efficient smart contract automation features. Chainlink Automation is a secure and cost-efficient service tailored for Web3 developers,…

-

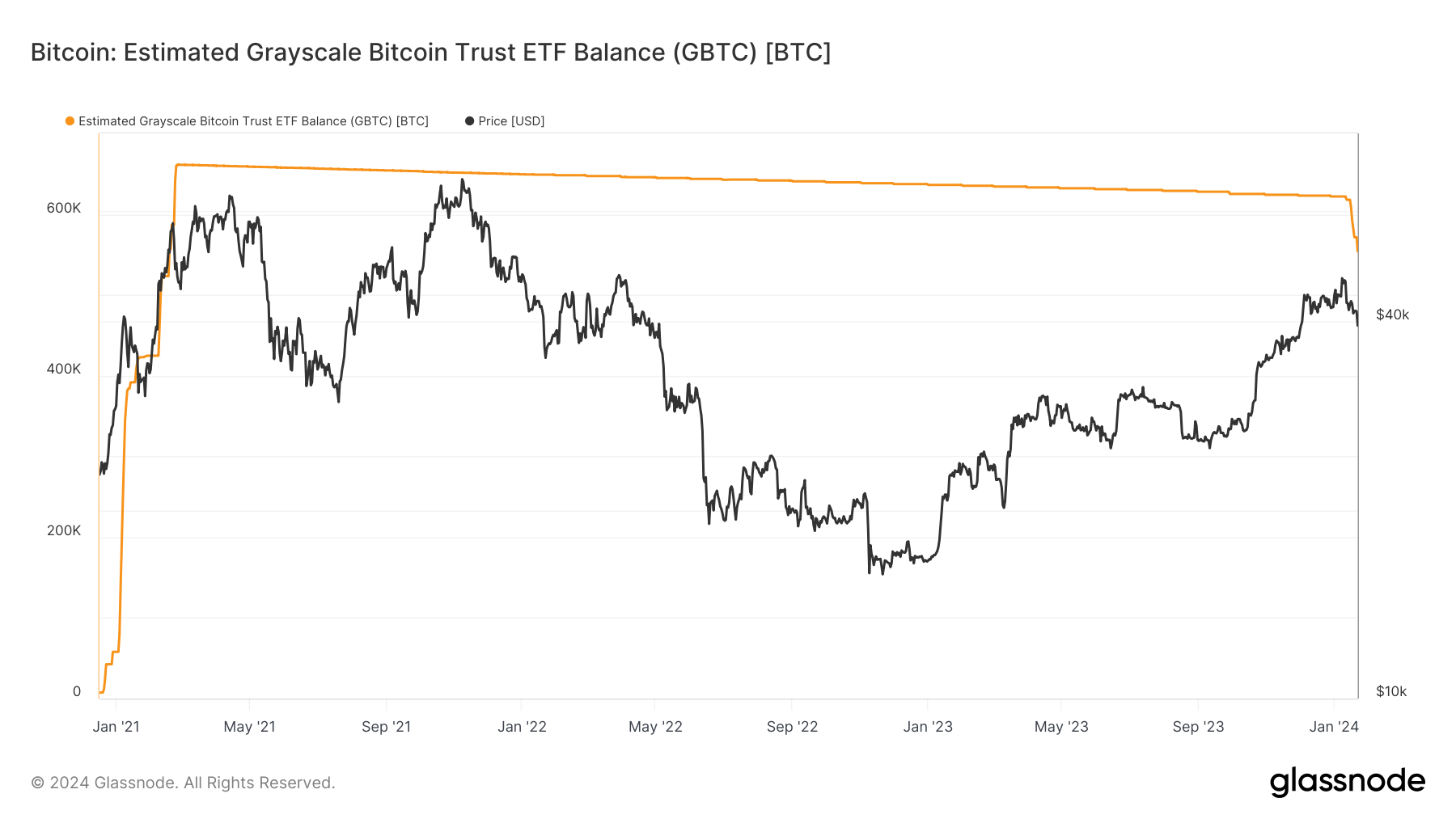

Grayscale Bitcoin Trust balance sees 12% reduction as FTX bankruptcy stirs $3.5 billion outflow

[ad_1] Quick Take Recent data analysis from Glassnode reveals a substantial decrease in the balance of the Grayscale Bitcoin Trust ETF (GBTC), now estimated at around 553,000 Bitcoin, which is roughly 12% down from its high of 630,000 Bitcoin. A key contributing factor to this decline appears to be the increasing outflows, which have been…