Author: e_cash_top

-

Binance says that DOJ settlement lacks relevance in SEC case as it moves for dismissal

[ad_1] Binance submitted two key filings on Dec. 12 in an ongoing case previously launched by the the U.S. Securities and Exchange Commission (SEC). Binance’s first filing moves to dismiss the case that the SEC launched against its companies and its former CEO Changpeng Zhao in June. The filing asserts that the SEC has not…

-

Argentina’s new president tackles monetary policy with 50% currency devaluation

[ad_1] In a bold move to address Argentina’s deepening economic crisis, President Javier Milei‘s administration has implemented a sweeping 50% devaluation of the national currency, the Argentine peso. This radical measure, announced on Dec. 12, marks a significant shift in the nation’s approach to combating its longstanding financial troubles. 50% devaluation As part of a…

-

OFAC and CoinList reach $1.2M settlement over Russian sanctions violations

[ad_1] The U.S. Treasury’s Office of Foreign Assets Control (OFAC) announced a settlement with the crypto exchange CoinList on Dec. 13. Over a two-year period ending in May 2022, CoinList processed 989 transactions worth $1.25 million from users who ordinarily resided in Crimea. The agency called this an “apparent violation” of its sanctions related to…

-

Vitalik Buterin proposes ‘enshrined zkEVM’ to address layer-2 challenges on Ethereum

[ad_1] Ethereum co-founder Vitalik Buterin introduced a new concept for the blockchain platform called an “enshrined Zero-Knowledge Ethereum Virtual Machine (ZK-EVM) in a Dec. 13 blog post. The main goal of the proposal is to substantially improve the efficiency and security of Ethereum’s Layer-2 protocols, which include optimistic and ZK rollups. Addressing challenges in Layer-2…

-

Gary Gensler dismisses role of crypto in capital markets while fielding Bitcoin ETF questions

[ad_1] U.S. Securities and Exchange Commission (SEC) chair Gary Gensler spoke dismissively of spot Bitcoin ETFs in a conversation with Bloomberg on Dec. 13. Gensler’s SEC today introduced new rules that are intended to reduce risk in the U.S. Treasury market. According to Reuters, those rules will require a greater number of trades to go…

-

Ethereum sees major shift from centralized exchanges to DeFi

[ad_1] What is CryptoSlate Alpha? A web3 membership designed to empower you with cutting-edge insights and knowledge. Learn more › Connected to Alpha Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below. Oops…you must lock a minimum of 20,000 ACS If you don’t have enough, buy ACS…

-

Bitcoin Startup Lab debuts BRC-20 LABB token to nurture BTC startup community

[ad_1] San Francisco-based Bitcoin Startup Lab, a Bitcoin pre-accelerator firm, has introduced LABB, a community-centric BRC-20 token designed to empower BTC entrepreneurs, per a Dec. 13 statement shared with CryptoSlate. The LABB token aims to foster a community of visionaries intending to launch Bitcoin-focused startups. The token acts as a supportive gateway, providing utility for…

-

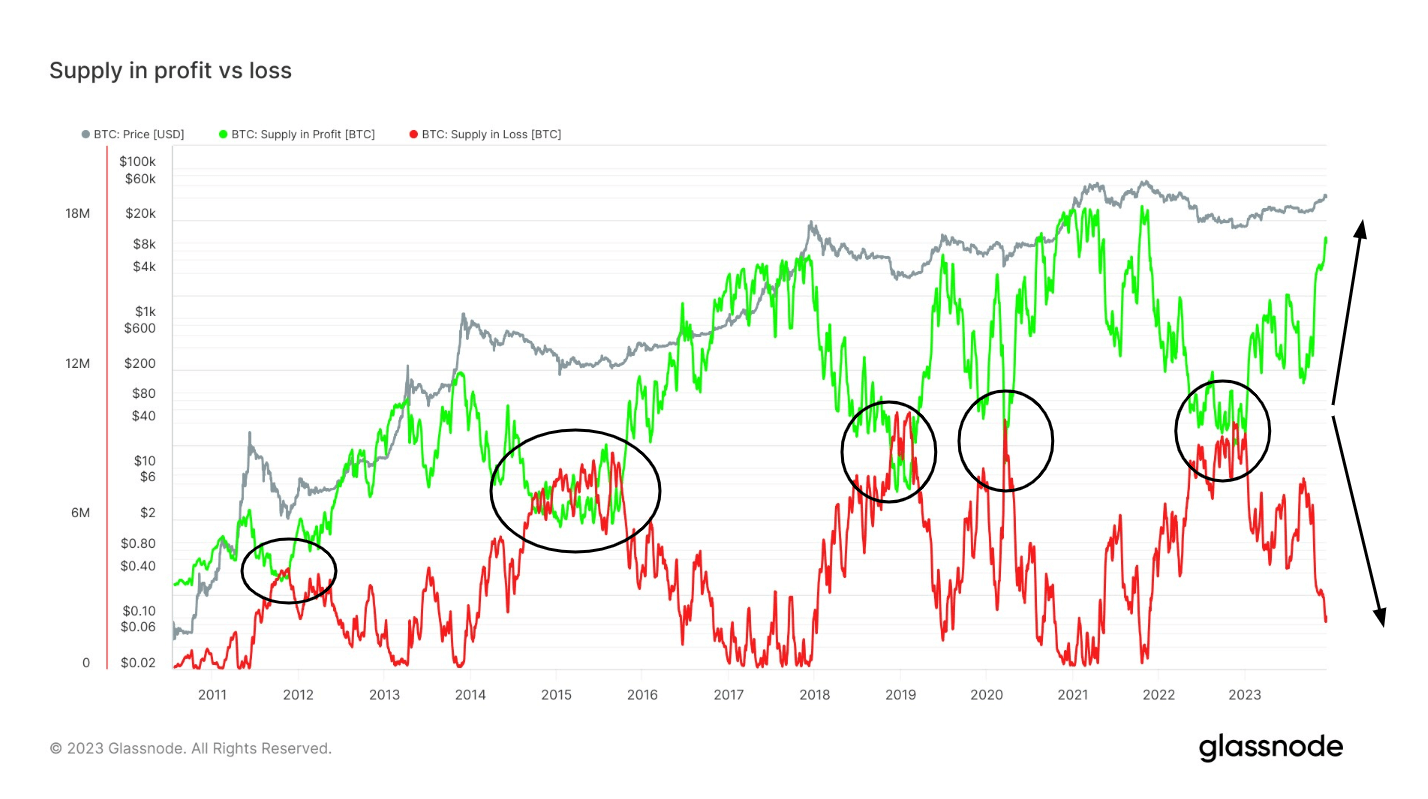

Profitable Bitcoin supply nears cycle peak, could precede market correction

[ad_1] Quick Take Analyzing the supply dynamics of Bitcoin reveals a telling story of profit and loss convergence, a significant indicator of market fluctuations. Of the approximately 19.3 million Bitcoin in circulation, an estimated 17.3 million are in profit, leaving 1.9 million at a loss. The convergence of supply in profit and loss – where…

-

Three Arrows Capital’s Su Zhu reportedly near release following good behavior in custody

[ad_1] Su Zhu, co-founder of the now-defunct crypto hedge fund Three Arrows Capital (3AC), is slated for release later this month after spending several months in custody, Bloomberg reported on Dec. 13. In September, Zhu got a four-month jail sentence due to non-cooperation in the liquidation process of the collapsed firm. As per the Bloomberg…

-

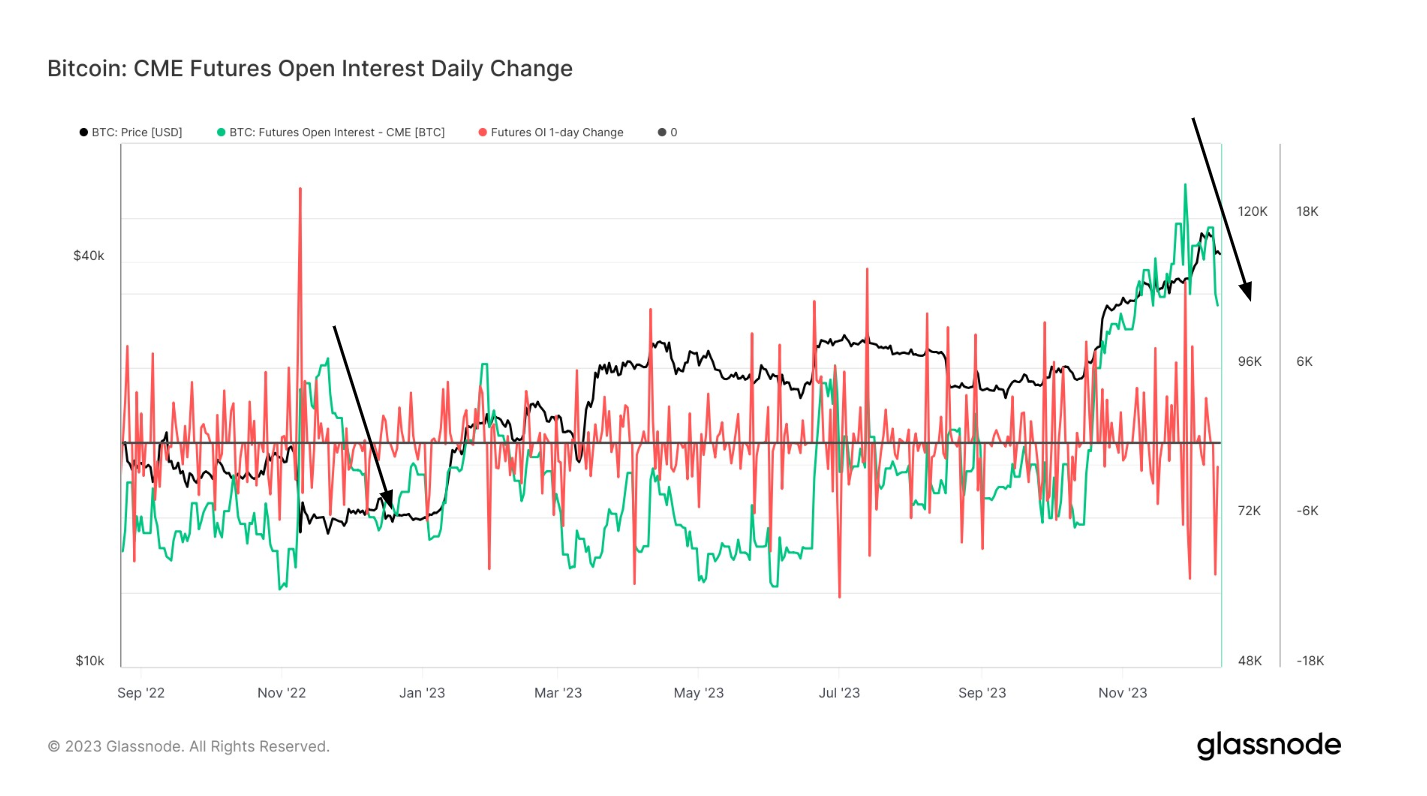

Chicago Mercantile Exchange Bitcoin futures Open Interest falls as year-end approaches

[ad_1] Quick Take From mid-October, the Chicago Mercantile Exchange (CME) has maintained its position as the premier exchange for Bitcoin futures, augmenting its Open Interest by approximately 45,000 BTC through to the end of November. However, this shift was marked by approximately 20,000 Bitcoin contracts being closed from CME since Nov. 28. In a notable…