Author: e_cash_top

-

Vanguard, BlackRock up MSTR holdings, while TradFi firms continue disclosing Bitcoin ETF investments

[ad_1] Vanguard and BlackRock have increased their stakes in MicroStrategy holdings (MSTR) on May 10. Vanguard holds 1.6 million shares of MSTR worth $2.6 billion as of the end of the first quarter, up from 1.2 million shares worth $727.6 million at the end of December 2023. BlackRock now holds 1.2 million shares worth $2.1…

-

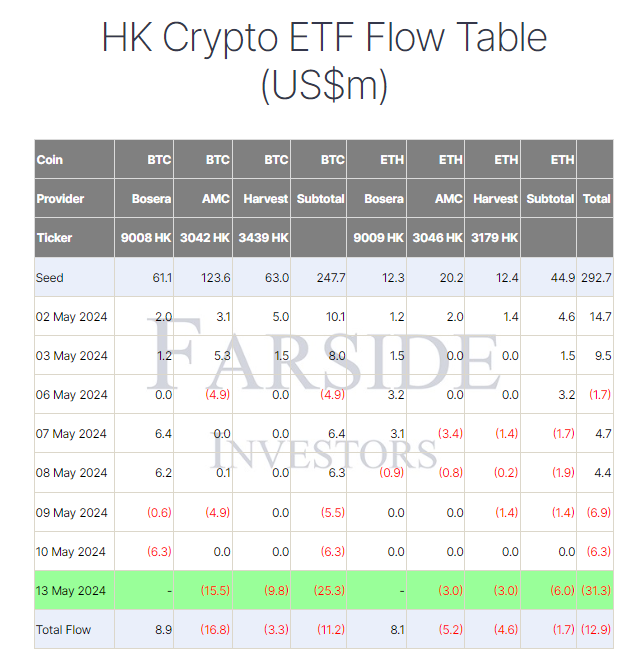

Hong Kong Bitcoin and Ethereum ETFs face record single-day outflows

[ad_1] Mining for the future: Bitcoin industry trends in the aftermath of the halving Andjela Radmilac · 5 hours ago CryptoSlate’s latest market report dives deep into the Hashrate Index Q1 report to determine the current state and future trajectory of Bitcoin mining. [ad_2] Source link

-

Crypto investment products see first inflow in weeks despite subdued trading volumes

[ad_1] Crypto-related investment products recorded their first inflow in over a month, totaling $130 million during the past week, according to CoinShares’ latest weekly report. The inflows mark a notable shift in investor sentiment after weeks of negative flows across the crypto market. However, the inflow did not improve investors’ participation in the asset class…

-

Layer 1, 2, 3, parachain, sidechain – What’s the difference?

[ad_1] The emergence of various blockchain scaling solutions has sparked discussions about the differences and roles of Layer 1, Layer 2, Layer 3, parachains, and sidechains in the evolving crypto ecosystem. Understanding these concepts is crucial for developers, investors, and users navigating the complex landscape of blockchain technologies – but it’s not always very clear…

-

New Hampshire representative proposes Bitcoin ETF investment to address state financial liabilities

[ad_1] New Hampshire State Representative Keith Ammon discussed the potential benefits of the state diversifying its financial reserves into Bitcoin exchange-traded funds (ETFs) in a May 12 social media post. The SEC approved trading spot Bitcoin ETFs on US exchanges in January. Since then, the products have generated huge interest, with major financial institutions like…

-

DeFi platforms Lido and Aave surpass Bitcoin and Ethereum in fee generation

[ad_1] Decentralized finance projects Lido and Aave generated more fees in the last 24 hours than top blockchain networks like Bitcoin, Ethereum, and Solana. According to DeFillama data, Lido accrued $2.34 million, while Aave amassed $1.85 million during this period. In contrast, Ethereum, Bitcoin, and Solana secured $1.84 million, $1.34 million, and $1.17 million, respectively,…

-

Mining for the future: Bitcoin industry trends in the aftermath of the halving

[ad_1] Introduction The first quarter of 2024 was crucial for the Bitcoin mining industry. With Bitcoin’s fourth halving less than a month into the second quarter, miners were accelerating their efforts to capitalize on higher rewards before they decreased. Understanding the impact of the halving is crucial, as it influences both the immediate mining profitability and…

-

El Salvador reveals Bitcoin treasury holdings, totaling over 5,700 BTC worth roughly $360 million

[ad_1] Quick Take El Salvador has taken a significant step towards transparency in its Bitcoin adoption journey. The National Bitcoin Office (ONBTC) of El Salvador has unveiled its Bitcoin treasury holdings. The ONBTC tweeted, “El Salvador now has its own mempool space where anyone can check out our bitcoin treasury holdings.” This milestone in proof…

-

Tether CEO Paolo Ardoino defends USDt compliance record in wake of Ripple CEO’s comments

[ad_1] Paolo Ardoino, CEO of Tether, has responded to Ripple CEO Brad Garlinghouse‘s claims that the US government was targeting the company, the issuer of the largest stablecoin USDt. During the weekend, reports emerged that Garlinghouse had suggested that a US government’s scrutiny of Tether could significantly affect the crypto industry. Garlinghouse said: “The US…

-

Ethereum has been increasingly inflationary for over a month as fees hit all-time low

[ad_1] Since Ethereum moved from proof-of-work to proof-of-stake in 2022, it has become a deflationary asset. The total circulating supply of Ethereum (ETH) currently stands at 120,105,358 ETH, representing a 415,680 ETH decrease from the supply levels observed before The Merge. However, over the past 30 days, Ethereum’s supply dynamics have shifted, with 35,548.72 ETH…