Author: e_cash_top

-

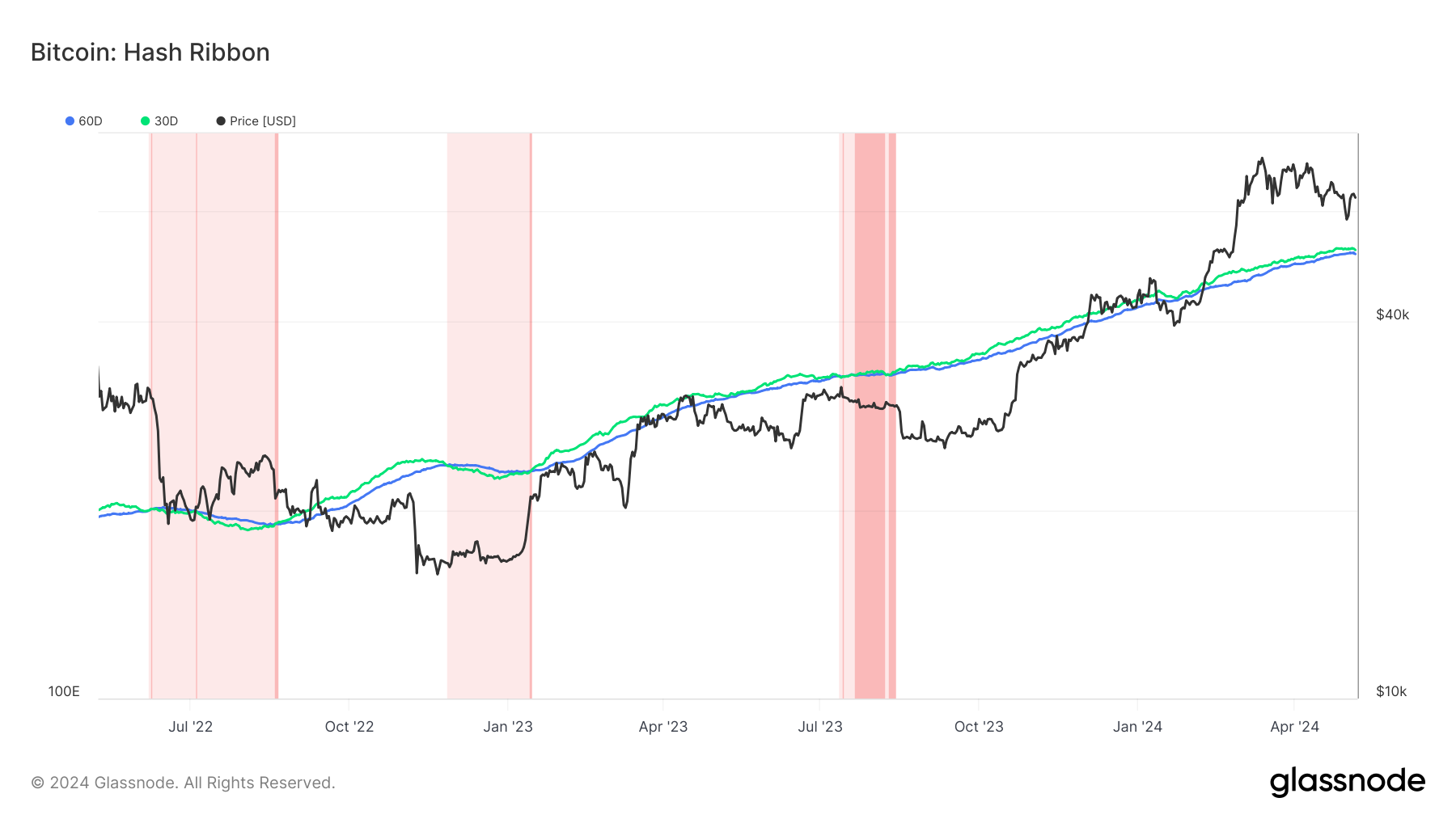

Bitcoin mining difficulty set for sharpest drop since FTX collapse

[ad_1] Quick Take Bitcoin’s mining difficulty is on the brink of its most significant downward adjustment since the FTX collapse in December 2022. Newhedge forecasts a reduction of over 4% on May 9, which would mark a substantial trend shift after the Bitcoin halving. The network’s hash rate has already dropped by 10% from its…

-

Crypto Super PACs raise $102M to support crypto-friendly US candidates

[ad_1] Crypto Super PACs have amassed $102 million in funds ahead of the US elections to advocate for candidates supportive of the industry, according to a report by Public Citizen. Approximately $54 million originates from direct corporate contributions, notably from industry giants Coinbase and Ripple Labs. Individual contributions from crypto executives and venture capitalists also…

-

Fidelity leads with inflows as Bitcoin ETFs capture $217M in one day

[ad_1] Quick Take According to Farside data, the Bitcoin ETFs (Exchange-Traded Funds) in the US witnessed another net inflow day on May 6, reaching $217.0 million. This massive influx comes just days after another significant inflow was recorded on May 3. Grayscale’s GBTC saw an inflow of $3.9 million, marking back-to-back inflows for the fund.…

-

CoinStats launches Degen Plan to enhance trading tools for serious crypto investors

[ad_1] CoinStats, a prominent crypto tracker and portfolio management platform, recently unveiled the Degen Plan — a premium subscription offering tailored for crypto investors seeking enhanced analytics capabilities. Degen is one of the most popular terms within the crypto industry. Coingecko defines Degen traders as those who take trades without due diligence and research, often…

-

Hightower Advisors, SouthState Bank disclose investments in spot Bitcoin ETFs

[ad_1] Hightower Advisors disclosed a $68 million investment in spot Bitcoin ETFs in a May 6 filing. The 13F filing indicates that the firm holds 709,956 shares of Grayscale’s GBTC worth $44.8 million, 200,084 shares of FBTC worth $12.4 million, 188,397 shares of BlackRock’s IBIT worth $7.6 million, and 23,964 shares of Ark Invest’s ARKB…

-

German central bank president calls for swift adoption of CBDCs to stay competitive.

[ad_1] Joachim Nagel, President of the Deutsche Bundesbank and a member of the ECB, emphasized the urgency for central banks to reassess their business models and swiftly adopt central bank digital currencies (CBDCs). Speaking at a high-level panel during the Bank for International Settlements (BIS) Innovation Summit on May 6, Nagel expressed concern over the…

-

The Digital Chamber slams SEC for issuing Wells Notice against Robinhood

[ad_1] The Digital Chamber, a crypto trade association, condemned the SEC for submitting a Wells notice to Robinhood Crypto. In a statement on May 6, the association expressed “profound disappointment and concern” over the action and called it an example of regulatory overreach. The Digital Chamber emphasized its ongoing opposition to the SEC extending its…

-

GBTC breaks 16-week outflow streak with $63 million inflow on May 3

[ad_1] Grayscale Bitcoin Trust (GBTC) experienced $63.0 million in inflows on May 3, Farside data indicates. The relevant daily inflows mark the first time since GBTC’s January launch that the fund avoided outflows, breaking its 16-week outflow streak. However, GBTC’s latest day of inflows is lower than its average daily outflows over the past several…

-

Nigeria to remove Naira from P2P trading platforms to curb currency manipulation

[ad_1] The Nigerian government has revealed intentions to delist the national currency, the Naira, from all peer-to-peer (P2P) trading platforms. Emomotimi Agama, the Director General of the Nigerian Securities and Exchange Commission (SEC), reportedly revealed this plan during a virtual meeting with the country’s blockchain stakeholders today as part of a wider effort to combat…

-

Custodia recruits distinguished solicitors in Federal Reserve case

[ad_1] Custodia Bank has hired two solicitors to represent it in its case against the US Federal Reserve, Politico reported on May 26. Custodia CEO Caitlin Long confirmed the news and said the two solicitors have a “deep understanding of federalism issues” and experience in federal regulation of the crypto industry. She also praised each…