Author: e_cash_top

-

Bitcoin supply analysis exposes a calm before the speculative storm

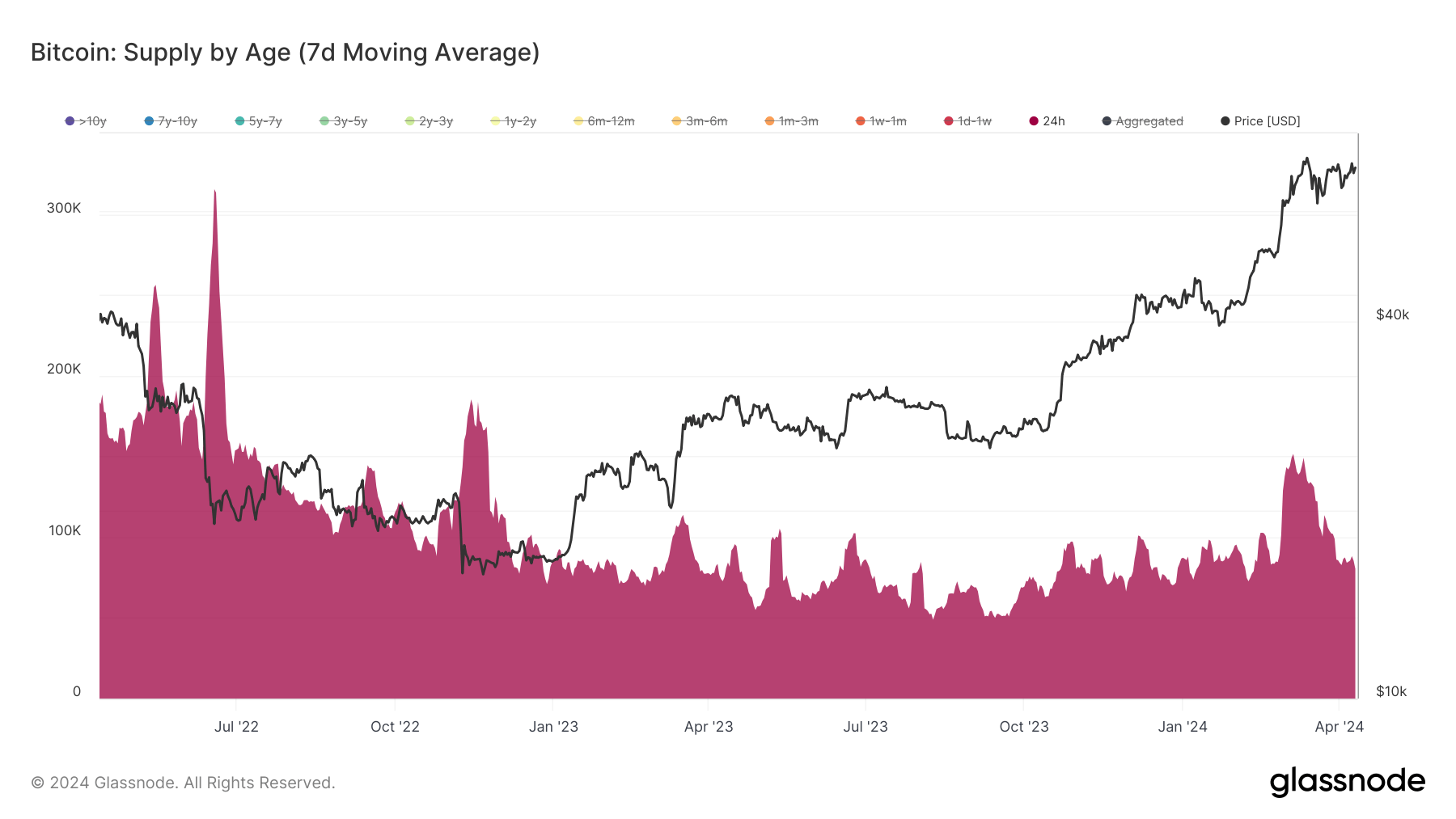

[ad_1] Quick Take The distribution of Bitcoin’s total supply among different cohorts provides valuable insights into investor behavior and market sentiment. Glassnode categorizes holders who have held Bitcoin for less than 155 days as Short Term Holders, while those holding for longer than 155 days are considered Long Term Holders. Supply by age, April 2022…

-

GBTC ETF records lowest outflow since launch: $17.5 Million

[ad_1] Quick Take Farside data indicates that Bitcoin (BTC) Exchange-Traded Funds (ETFs) experienced a significant inflow of $123.7 million on Apr. 10, following a period of consecutive outflows. Notably, the Grayscale GBTC ETF saw its lowest outflow at just $17.5 million since launch. However, its total outflows reached $15,981.0 billion. Bitcoin ETF Flow Table: (Source:…

-

Solana problems continue as leading DeFi founder quits amid wider ecosystem drama

[ad_1] Decentralized finance lending platforms MarginFi, SolBlaze, and Solend have found themselves embroiled in a heated dispute, with accusations of misconduct and misinformation being leveled by all sides. The controversy stems from MarginFi’s alleged failure to replenish BLZE token emissions for its users over an 8-day period, which MarginFi attributes to blockchain congestion and prioritizing…

-

Let’s integrate blockchain into the real economy

[ad_1] How many new Web3 solutions have you encountered recently? What was their value proposition? Most likely it was transaction scalability, fee reduction, speed optimization, or a new token for yet another payment system. It almost seems that the blockchain industry is stuck in a Groundhog Day of exclusively solving a single task: transferring currency…

-

Bitcoin’s dual nature: shifting between risk-on and risk-off amid market turbulence

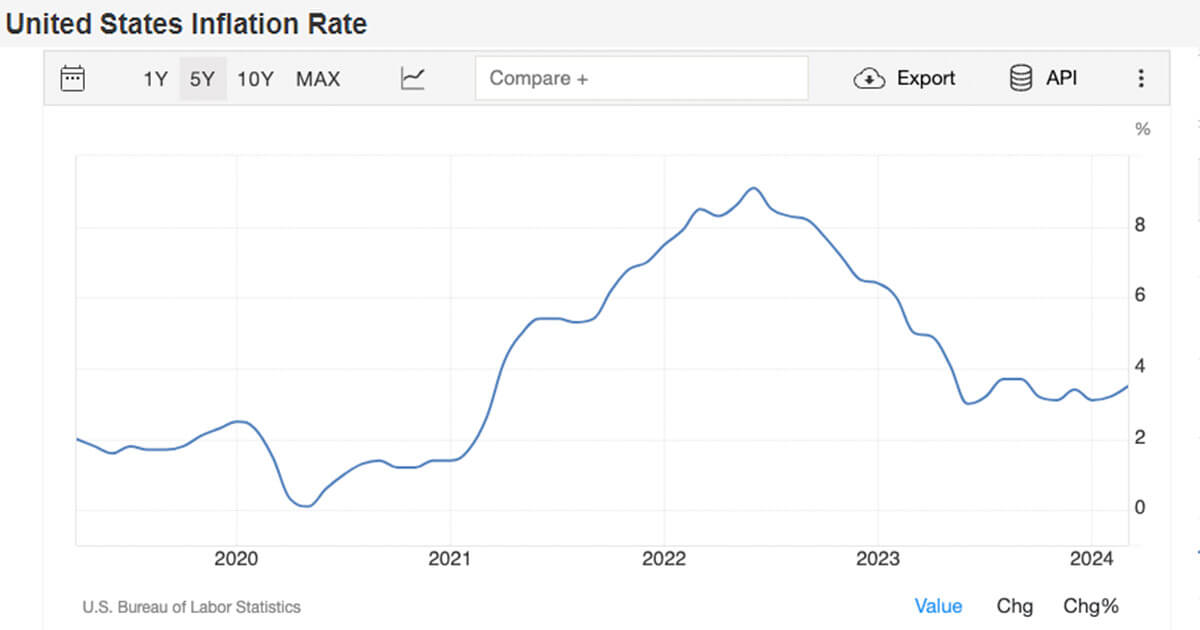

[ad_1] Quick Take The latest US inflation data has surprised analysts, with headline inflation year-over-year (YoY) coming in at 3.5% — 0.1% above forecasts. The development is significant considering the Federal Reserve’s most aggressive hiking cycle in decades, according to Statista, which aimed to tame the rampant inflation that the central bank initially claimed was…

-

CV Pad to Open Doors to the ‘Real’ World of Crypto, Says Co-Founder Florian Kohler

[ad_1] In Web3, the journey from an innovative idea to a successful venture is often fraught with challenges. At the heart of this journey lies the critical need for support, funding, and strategic partnerships. Enter Florian Kohler, the co-founder of CV Pad, a visionary platform aiming to redefine the venture capital model within the Web3…

-

Microsoft, AWS pledge $17.9 billion to develop AI technology in Japan as part of US deal

[ad_1] The US and Japan announced on April 10 a political understanding that includes a Microsoft partnership partially focused on AI. Under the deal, Microsoft will invest $2.9 billion in Japan over the next two years to support artificial intelligence (AI), cloud computing, and data centers. The investment will also go toward training 3 million…

-

Solana congestion issue caused by ‘too much demand’ – devs working on fix without ‘sleeping much’

[ad_1] Solana (SOL) core developers are working around the clock on a fix for the recent congestion issues on the network following an unprecedented surge in demand. Solana Labs head of communication Austin Federa said developers from across the ecosystem are involved in concerted efforts to improve the platform’s networking stack and resolve the issues…

-

EU watchdog warns of high concentration in crypto markets, notes minimal euro usage

[ad_1] The European Securities and Markets Authority (ESMA) warned that crypto markets are highly concentrated on April 10. ESMA said concentration is a concern because a single asset or exchange failure could broadly impact the crypto ecosystem. According to the agency’s findings, market capitalizations and trading volumes are “significantly concentrated” in a small number of…

-

Independent financial advisors start disclosing Bitcoin exposure via ETFs

[ad_1] Two financial advisors disclosed investments in spot Bitcoin ETFs on April 9. Signal Advisors, a Michigan-based startup serving independent financial advisors, disclosed ownership of 20,571 BlackRock iShares Bitcoin Trust (IBIT) shares. Wedmont Private Capital, a Philadephia-based Registered Investment Advisor (RIA), disclosed ownership of 3,471 shares of Fidelity Bitcoin ETF (FBTC). Spot Bitcoin ETF shares…