Author: e_cash_top

-

Lithuania to establish strict licensing regime for crypto firms by 2025

[ad_1] Lithuania is set to impose strict licensing requirements on crypto firms by 2025, which will significantly reduce the number of companies able to operate in the country. Central bank board member Simonas Krepsta told Bloomberg on April 3 that the move aims to establish robust oversight for the industry as digital assets are increasingly…

-

SEC director refutes narrative that regulator lacks regulatory framework for crypto

[ad_1] What is CryptoSlate Alpha? A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more › Connected to Alpha Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below. Important: You must lock a minimum of 20,000 ACS If you…

-

Cyprus’ 2013 banking crisis was Bitcoin’s origin as a safe haven asset

[ad_1] Quick Take During the 2013 Cyprus financial crisis, Bitcoin’s reaction provided an early indication of its potential as a “risk-off” asset and alternative safe haven. The instability in Cyprus’s banking system was attributed to lax regulation within the sector and overextension among property developers, as reported by The Guardian. Before the crisis escalated, on…

-

Coinbase embraces Bitcoin Lightning network to speed up transactions

[ad_1] US-based crypto exchange Coinbase is finally integrating Bitcoin Lightning network after several promises by the exchange CEO Brian Armstrong. In an April 3 statement, Lightspark, a lightning network-based payment infrastructure provider, revealed that it was selected by the crypto exchange to facilitate the integration of Bitcoin Lightning Network. Under this partnership, Coinbase will leverage…

-

UK regulators launch sandbox to integrate DLT with financial system

[ad_1] The Bank of England (BoE) and the UK Financial Conduct Authority (FCA) have announced the launch of the Digital Securities Sandbox (DSS) on April 3. The new framework aims to facilitate the use of emerging technologies, such as distributed ledger technology (DLT), in issuing, trading, and settling financial securities. It will allow participating firms…

-

Nigeria and Interpol collaborate to extradite Binance executive amid money laundering charges

[ad_1] The Nigerian Government has engaged the International Criminal Police Organization, Interpol, to facilitate the extradition of Binance executive Nadeem Anjarwalla, who is currently on the run, as reported by local media outlet Punch. Meanwhile, Binance has urged the Nigerian authorities to release its other executive, Tigran Gambaryan, currently within their hold. The firm said:…

-

Solana’s stablecoin supply surges past $3 billion, USDC leads the charge

[ad_1] Stablecoin supply on the layer-1 blockchain network Solana has increased steadily since the beginning of the year, crossing the $3 billion mark during the past week. Data from the blockchain analytical platform Artemis shows that the stablecoin supply on the network has increased by 55.72% in the last three months to reach $3.12 billion.…

-

Despite Grayscale and ARK’s outflows, Bitcoin ETF market records net inflow

[ad_1] Quick Take Bitcoin (BTC) exchange-traded funds (ETFs) on Apr. 2 experienced a moderate net inflow of $40.3 million, according to Farside data. Particularly noteworthy is the Grayscale Bitcoin Trust (GBTC), which saw a relatively smaller outflow of $81.9 million, signaling a significant slowdown from previous outflows. GBTC has now totaled $15,152.0 billion in net…

-

IoTeX secures $50M investment expanding dePIN narrative for next cycle

[ad_1] The decentralized Physical Infrastructure Network (DePIN) platform IoTeX, has secured a $50 million investment from a consortium of venture capital firms to accelerate the growth and adoption of its ecosystem. According to information shared with CryptoSlate, the investment round was led by SNZ Capital, Foresight Ventures, FutureMoneyGroup, Borderless Capital, and others, with the funds…

-

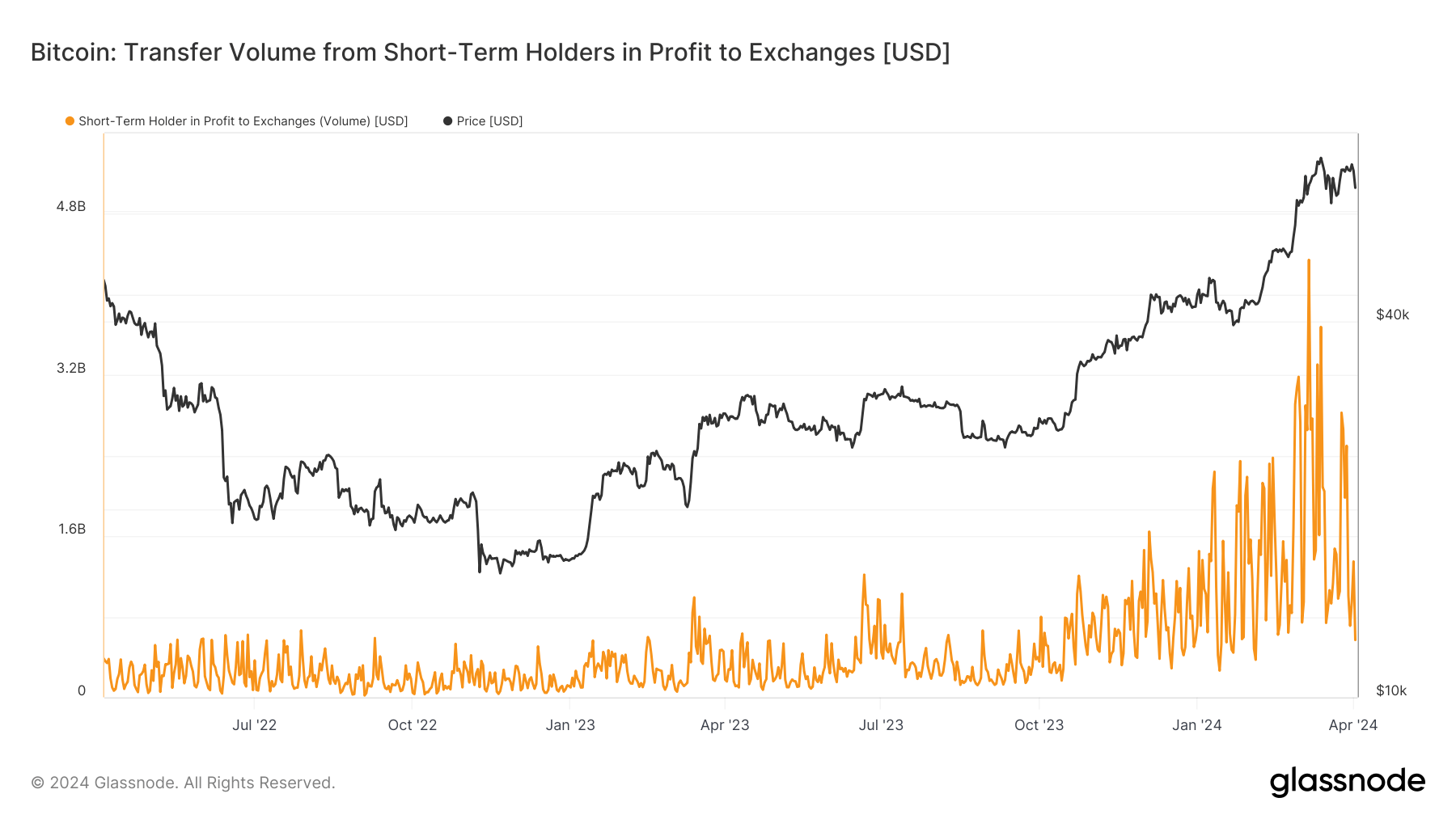

Emotional trading patterns hit short-term Bitcoin holders’ wallets

[ad_1] Quick Take As Bitcoin’s price has surged roughly 50% since the beginning of 2024, data from Glassnode reveals a noteworthy pattern in behavior among short-term holders (STHs), defined as investors holding Bitcoin for less than 155 days, who tend to exhibit a pattern of fear and greed—buying high and selling low. Glassnode data shows…