Author: e_cash_top

-

Grayscale executive sees path to Ethereum ETF approval despite SEC silence

[ad_1] Craig Salm, the Chief Legal Officer at Grayscale, suggested that the US SEC’s “perceived lack of engagement” with spot Ethereum exchange-traded funds (ETFs) applicants wouldn’t be a decisive factor that would hinder the prospects of such products. In a March 25 post on X (formerly Twitter), Salm said the Ethereum ETFs would be approved…

-

United States OFAC places new sanctions on crypto firms with ties to Russia

[ad_1] The US Department of the Treasury’s Office of Foreign Assets Control (OFAC) has sanctioned 13 entities and two individuals for operating in the financial services and technology sectors of the Russian economy, including those developing or offering services in virtual assets that reportedly enable the evasion of US sanctions, as reported by the Treasury…

-

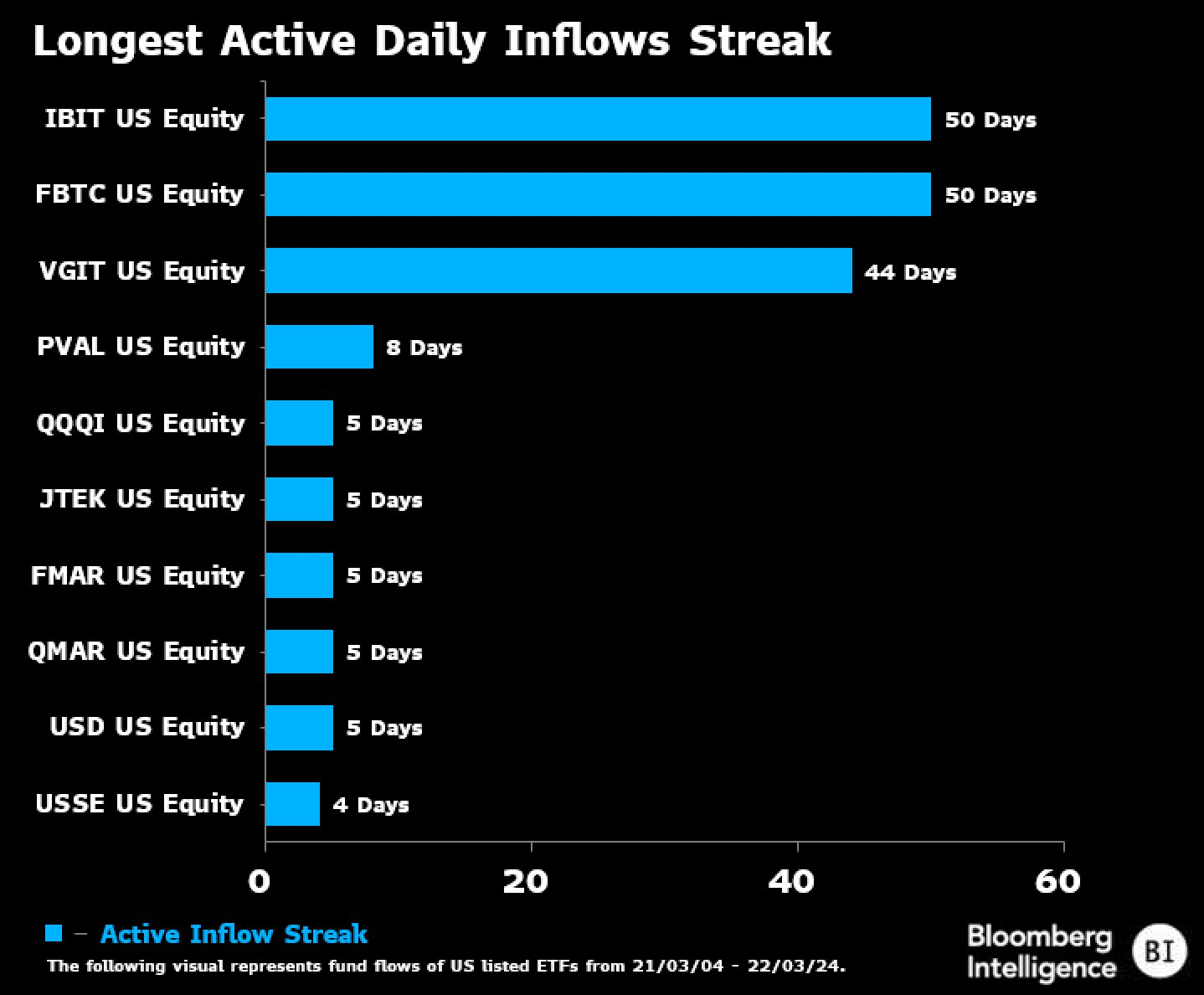

Bitcoin ETFs break trend recording modest inflows as GBTC continues outflow

[ad_1] Quick Take According to data from BitMEX, the Bitcoin (BTC) ETF market experienced its first day of net inflows since March 15, collecting a modest $15.7 million, or 221.2 Bitcoin. This event paused five consecutive days of net outflows and represented the second-smallest day of inflows recorded. Despite this positive shift, the larger narrative…

-

SEC begins multi-billion dollar fraud trial against Terraform Labs, Do Kwon

[ad_1] In a dramatic opening to a much-anticipated trial, the US SEC cast Terraform Labs and its co-founder, Do Kwon, as central figures in a vast financial deception that left investors nearly destitute following its collapse, Reuters reported on March 26. The trial, unfolding in the US District Court for the Southern District of New…

-

Ripple execs reveal SEC seeking $2 billion in fines, say regulator has ‘become unhinged’

[ad_1] Ripple CEO Brad Garlinghouse and CLO Stuart Alderoty have revealed that the SEC is seeking a staggering $2 billion in fines and penalties. According to the company’s executives, the fines have been proposed in a court filing that will be unsealed on March 26. ‘Unhinged’ SEC Garlinghouse said the SEC is seeking heavy penalties…

-

SWIFT completes second test phase of CBDC with smart contract, atomic settlement capability

[ad_1] SWIFT said on March 25 that it discovered several applications for its central bank digital currency (CBDC) solution following a successful six-month test. The company did not create its own CBDC but instead developed an interlinking solution for existing CBDCs — dubbed the SWIFT connector. The company wrote: “At the core of our solution…

-

BlackRock’s Bitcoin ETF achieves legendary status after hitting second-largest inflows for 2024

[ad_1] What is CryptoSlate Alpha? A web3 membership designed to empower you with cutting-edge insights and knowledge, powered by Access Protocol. Learn more › Connected to Alpha Welcome! 👋 You are connected to CryptoSlate Alpha. To manage your wallet connection, click the button below. Important: You must lock a minimum of 20,000 ACS If you…

-

DeFi Education Fund files lawsuit to exempt airdrops from SEC’s securities classification

[ad_1] The DeFi Education Fund, a crypto advocacy group, and Texas-based apparel company Beba LLC have jointly initiated legal proceedings against the US SEC to clarify the status of airdrops as non-securities offerings. The March 25 court filing emphasized the need to halt the SEC’s regulatory actions, which the two entities perceive as an overreach…

-

London Stock Exchange sets May 28 launch date for Bitcoin, Ethereum ETNs

[ad_1] The London Stock Exchange said in a March 25 notice that it plans for Bitcoin (BTC) and Ethereum (ETH) crypto exchange-traded notes (ETNs) to begin trading on May 28. The latest announcement also details other key dates. The London Stock Exchange will begin accepting applications for admission from issuers on April 8. The FCA…

-

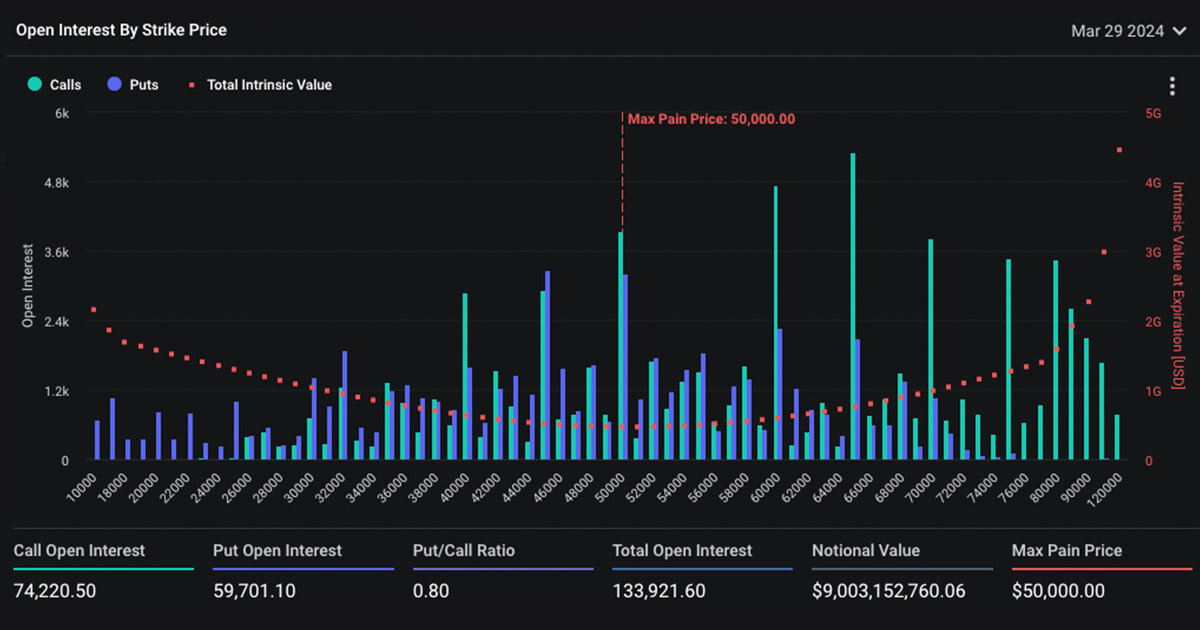

$9 billion in Bitcoin options set to expire on March 29

[ad_1] Quick Take Deribit data indicates that nearly $9 billion worth of Bitcoin (BTC) options are due to expire on March 29, the last Friday of the month, with the total open interest amounting to 133,914 BTC. The put/call ratio is reported at 0.80, signifying more calls in circulation compared to puts, and reflects bullish…