Category: Latest news

-

What’s behind the nearly $1 billion surge in blockchain gaming investments

[ad_1] The following is a guest post from Yaniv Baruch, COO at Playnance. The first quarter of 2024 reinvigorated investors’ sentiment in the crypto market. With the landmark litigation against the SEC ending, US investors have finally received access to spot Bitcoin ETFs. This opened the doors to Web3 for large institutional investors: the weekly…

-

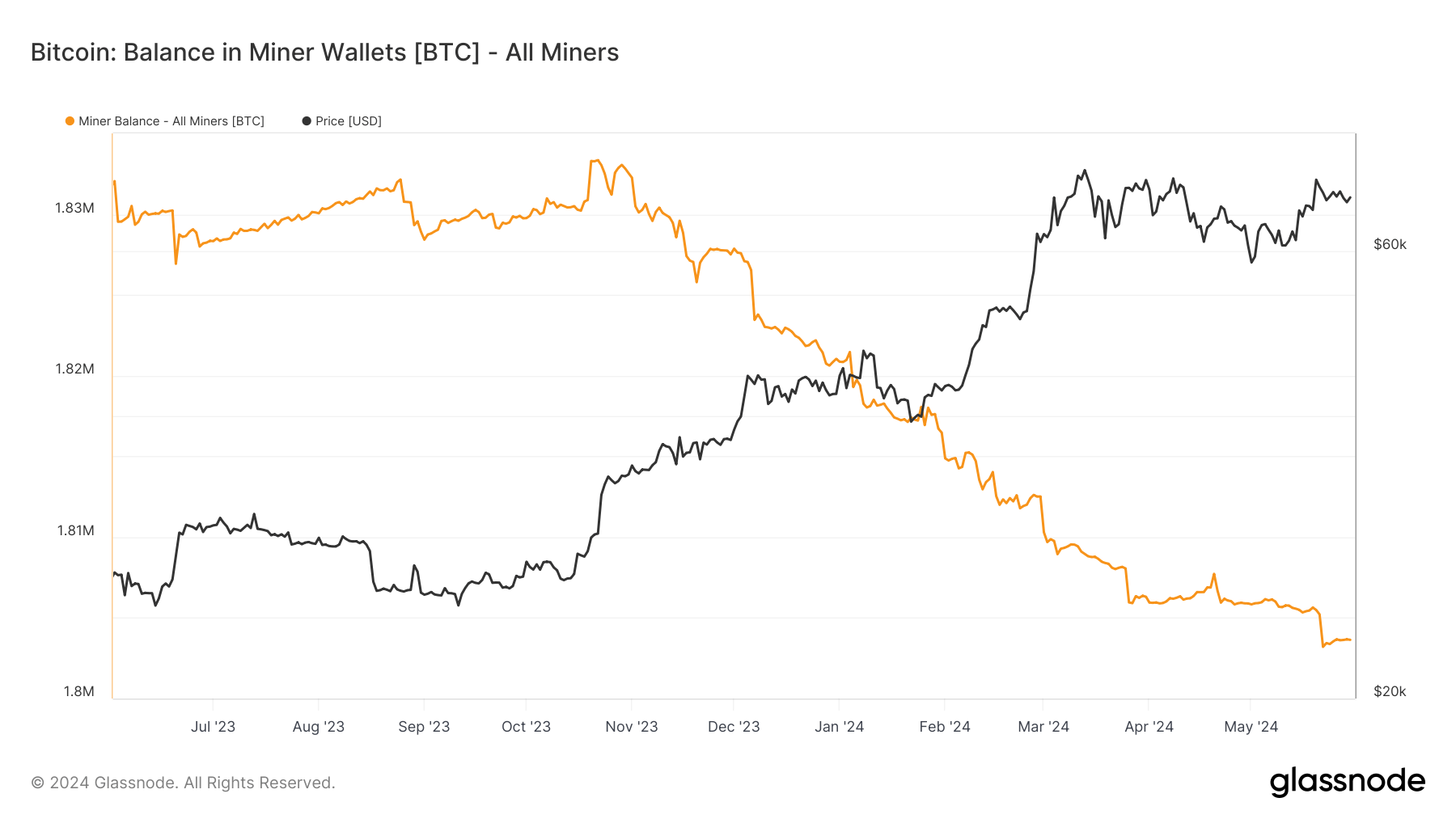

Bitcoin miner balances fall below 1.81 million BTC, lowest in years post-halving

[ad_1] Onchain Highlights DEFINITION: Balances in miner wallets are the total supply held in miner addresses. Bitcoin miner balances have shown significant shifts in recent months. The balance in miner wallets has seen a steady decline since late 2023, reaching lows not seen in years, reflecting miners’ responses to the recent Bitcoin halving in April…

-

Where crypto angel investors should deploy capital after Ethereum ETH approval

[ad_1] The following is a guest post from Tim Haldorsson, CEO of Lunar Strategy. In nine short years, Ethereum has gone from pioneering on-chain smart contracts and programmable crypto to becoming the backbone of decentralized finance and blockchain infrastructure. The recent SEC approval of ETH ETFs is just a single step in this journey, albeit…

-

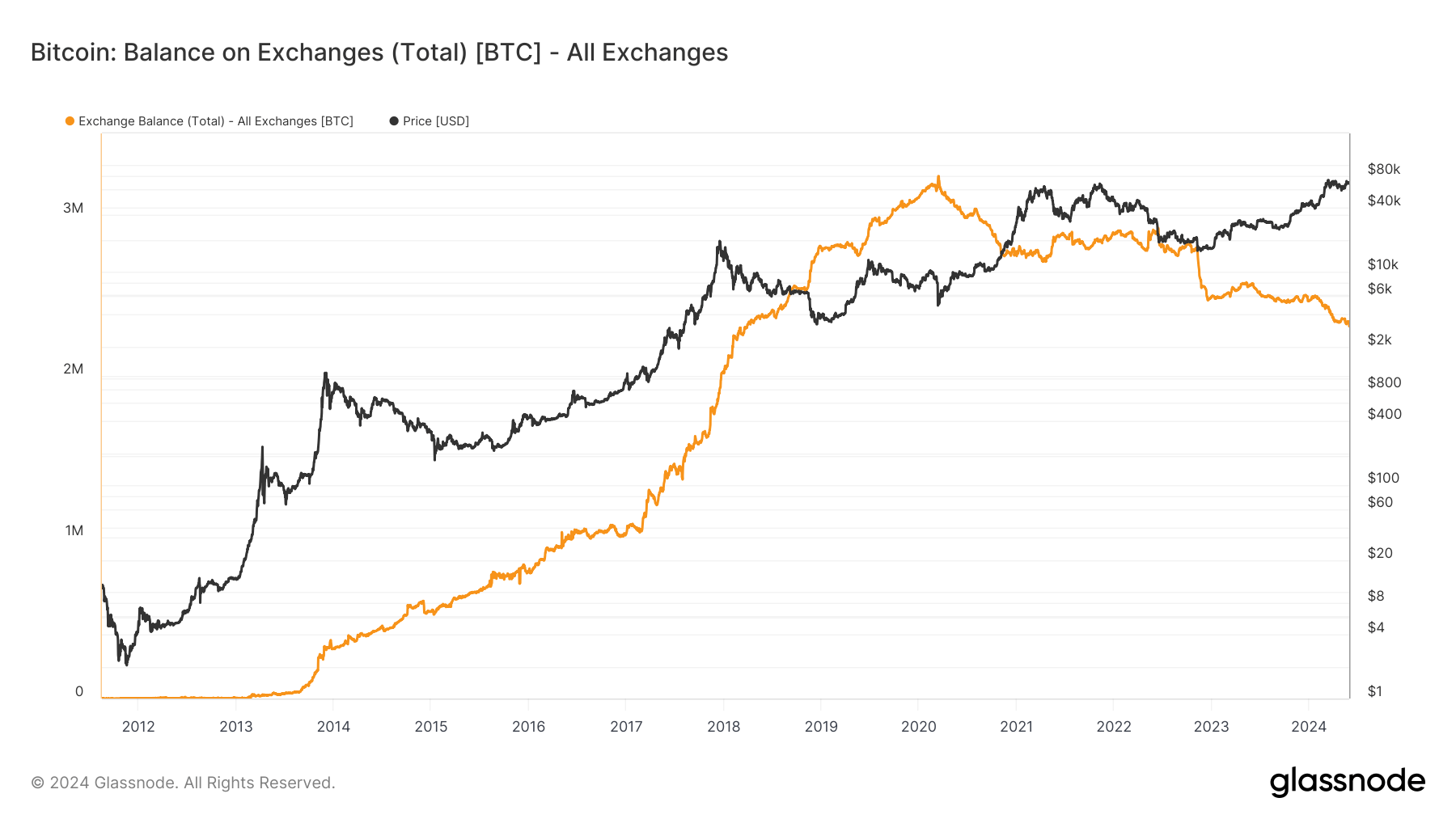

Bitcoin exchange balances decline to five-year low, major outflows from Binance and Coinbase signal long-term holding strategies

[ad_1] Onchain Highlights DEFINITION: Balances on exchanges are the total amount of coins held on exchange addresses. Bitcoin’s balance on exchanges has continued its downward trend, reaching a significant low. As of the latest data, the total balance on exchanges has dropped below 2.3 million BTC, a level not seen since March 2018. Substantial outflows…

-

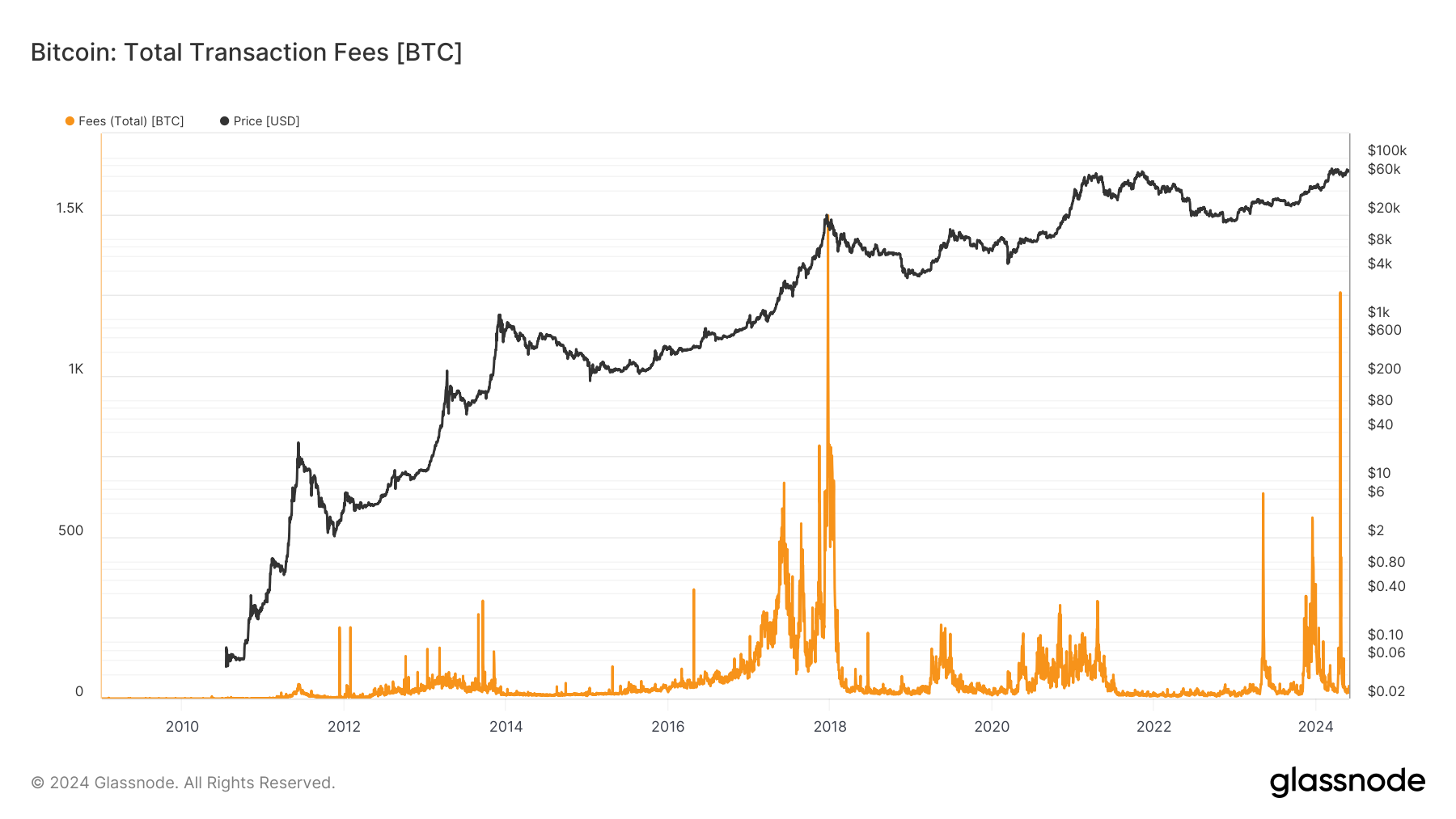

Surging Bitcoin fees post-halving highlight new revenue dynamics for miners

[ad_1] Onchain Highlights DEFINITION: Total transaction fess are the total amount of fees paid to miners. Issued (minted) coins are not included. Bitcoin’s total transaction fees surged notably earlier in 2024. Following the halving event in April, fees have seen a marked increase, momentarily reaching record highs. This rise is largely attributed to the introduction…

-

Privacy as a human right in crypto: An uncompromising stand

[ad_1] The following is a guest post by Felix Mohr, Co-founder at MohrWolfe.In an age where our digital footprints are scattered across the expanse of the internet like breadcrumbs, the concept of privacy has become as elusive as it is precious. As we navigate the aftermath of COVID-19—a time that has immeasurably digitized human interactions—our…

-

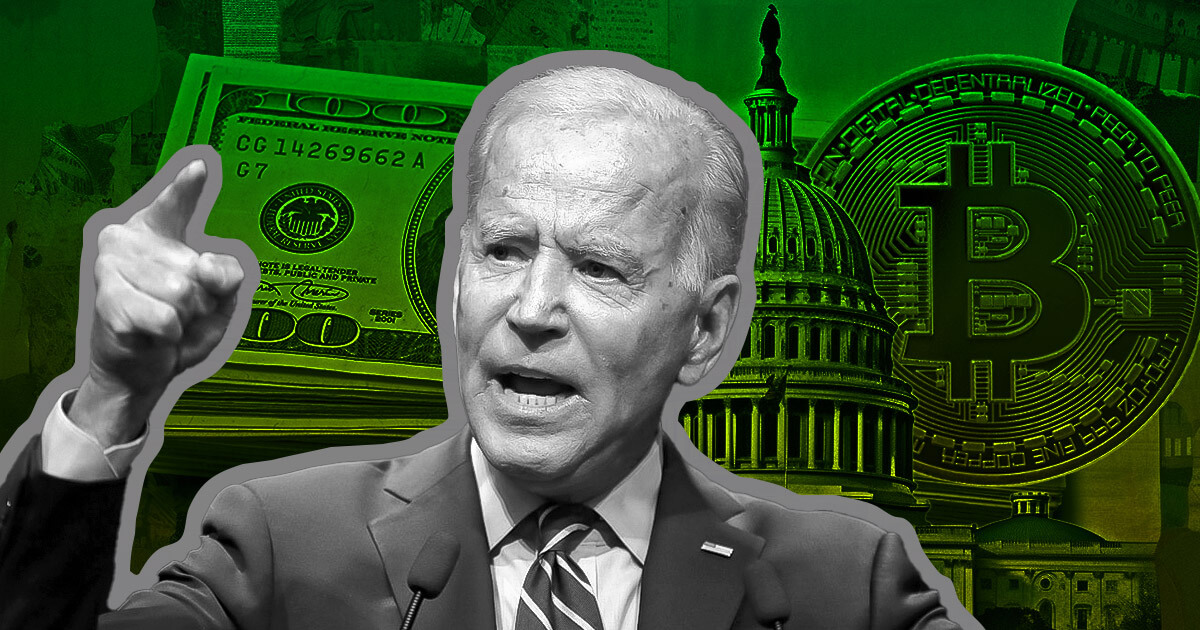

Biden vetoes resolution to overturn of SEC’s controversial SAB 121

[ad_1] US President Joe Biden vetoed H.J. Res. 109, which aimed to overturn the of the SEC’s controversial SAB 121 rule, on May 31. Biden wrote that SAB 121 represents the “considered technical” views of SEC staff. He added that the resolution would constrain the SEC’s ability to set guardrails and address future issues and…

-

21Shares drops Ark from ETH ETF as remaining applicants meet SEC deadline

[ad_1] Six companies updated their spot Ethereum ETF S-1 registration statements on May 31, with 21 Shares notably dropping Ark Invest from its filing. The relevant filing renames the “Ark 21Shares Ethereum ETF” to the “21Shares Core Ethereum ETF.” It also removes all mention of Ark Invest from its text, whereas previous submissions described Ark…

-

Lawmakers urge Biden administration to reconsider veto for SAB 121 repeal

[ad_1] A bipartisan coalition of lawmakers has urged the Biden Administration to abandon its plan to veto the Congressional proposal to repeal the SEC’s controversial Staff Accounting Bulletin No. 121 (SAB 121). The letter, dated May 30, called on the administration to urge the SEC to rescind the standard or sign the Congressional proposal to…

-

Congress to discuss potential benefits of RWA tokenization in June hearing

[ad_1] The House Financial Services Digital Assets Subcommittee will hold a hearing on real-world asset (RWA) tokenization on June 5 to discuss the emerging sector’s potential benefits. Congress will listen to testimony from industry experts at the hearing to determine the potential benefits of RWA tokenization in facilitating efficient markets. The US government’s decision to…