Category: Latest news

-

Is Bitcoin the next asset to catch up with the rally?

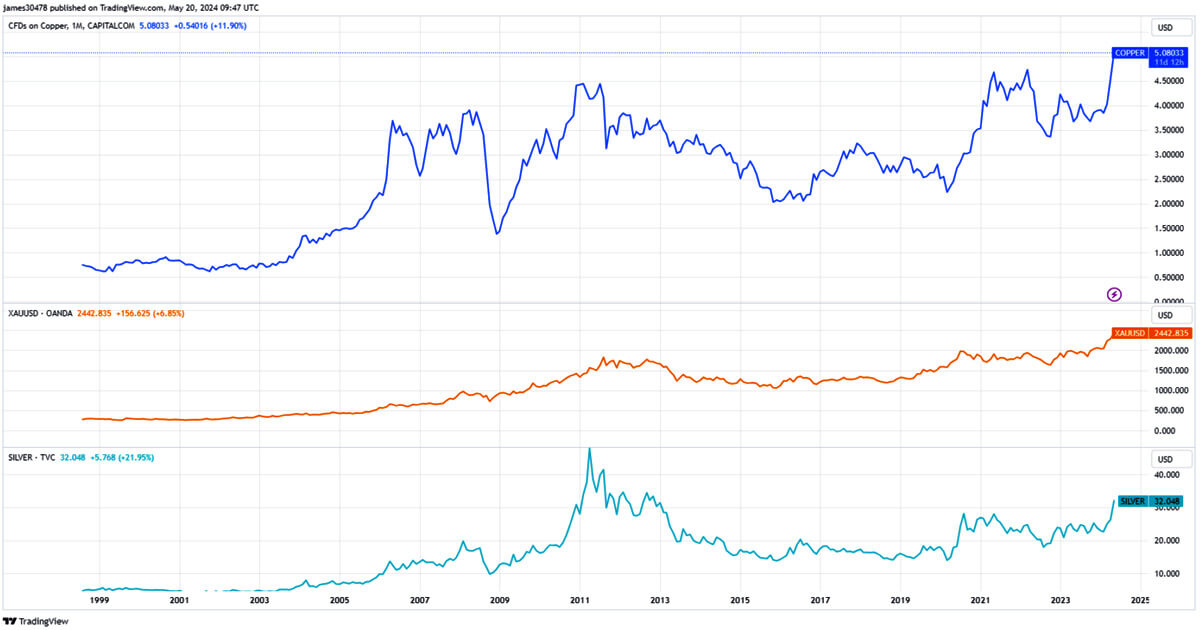

[ad_1] Quick Take As economic uncertainty looms, traditional safe-haven assets like gold, silver, and copper are soaring to new heights. Gold recently hit a new all-time high of $2,443 an ounce, up nearly 20% year-to-date. Silver is approaching $32 an ounce, its highest level since October 2012, while copper is trading above $5, an all-time…

-

Dr Wright’s explanations are ‘absurd’ and ‘plainly forged’ Judge states in written judgment

[ad_1] The full written judgment in Dr. Craig Wright vs. COPA was released this morning, May 20, including damning indictments of Dr. Wright’s actions during the trial. “Dr Wright lied to the Court extensively and repeatedly. Most of his lies related to the documents he had forged which purported to support his claim. All his…

-

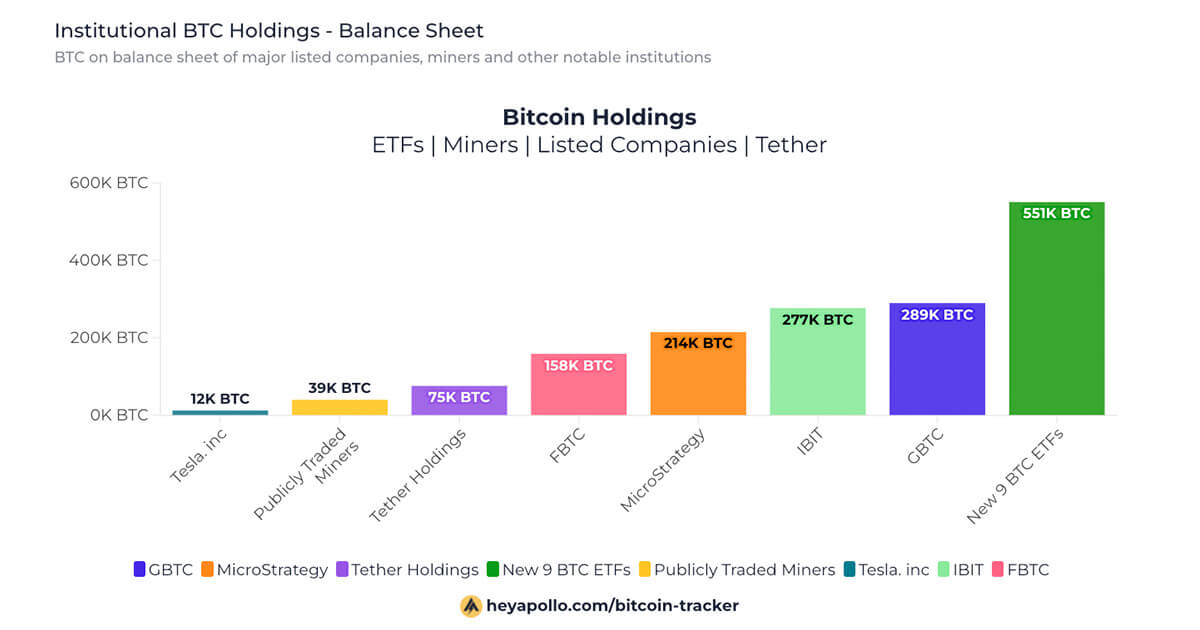

U.S. Bitcoin ETFs notch $948.3 million in accumulation over five days

[ad_1] Quick Take Farside data shows that Bitcoin (BTC) exchange-traded funds (ETFs) accumulated an impressive $948.3 million over five consecutive trading days. This remarkable streak marks the first time such a feat has been achieved from March 11 to March 15. Bitcoin ETF Flow Table: (Source: Farside) Farside data shows that on May 17 alone,…

-

Will the complexity of web3 win over web2?

[ad_1] The following is a guest post from Bakhrom Saydulloev, Product Lead at Mercuryo.Statistics works in a funny way. When experts feel the need to prove the growing acceptance and awareness of Web3, they over-simplify the concept to say, for instance: “more than 90% of people have heard of crypto, hooray!” And yes, that is,…

-

Building the interconnected Internet of Blockchains

[ad_1] Since the advent of Bitcoin in 2009 and the explosion of innovation that followed, the web3 industry has faced many challenges. Beyond dealing with regulators, improving UX, and weeding out bad actors, blockchain engineers continue to tackle two major hurdles: scalability and interoperability. While many Layer 2s are working to scale Layer 1s like…

-

Using Power Laws to predict when the Bitcoin price will hit $1 million

[ad_1] The following is a guest post by Rajagopal Menon, the Vice President of WazirX.Come the bull market, cometh the models to predict the price of Bitcoin. In the last bull market in 2021, the Stock-to-Flow (S2F) model was the flavour of the season. This model, created by Plan B, assessed asset scarcity by comparing…

-

Analyzing the US Government’s Bitcoin holdings: What you need to know

[ad_1] The following is a guest post from Vincent Maliepaard, Marketing Director at IntoTheBlock. According to the latest data from IntoTheBlock, the U.S. government holds over 1% of the Bitcoin supply, valued at an impressive $13.16 billion. These holdings have tripled since 2021, demonstrating a consistent increase over the years. Why the US government holds…

-

Coinbase expects 30% to 40% chance of spot ETH ETF approval by month-end

[ad_1] Crypto exchange Coinbase believes the odds of the SEC approving spot Ethereum ETFs by the end of the month stand between 30% to 40%. In a May 15 report, Coinbase Institutional Research Analyst David Han asserted that the main factor that led the SEC to approve spot Bitcoin ETFs — the correlation between CME…

-

Tether holds more US Treasuries than Germany, ranks 19th globally

[ad_1] Quick Take Tether reported a massive $4.52 billion profit in the first quarter of the year. Notably, the stablecoin issuer’s consolidated financial figures revealed that as of March 31, it held a staggering $91 billion in direct and indirect US treasury bill holdings. Meanwhile, the company also holds a substantial $5.4 billion in Bitcoin.…

-

Kraken considers delisting USDT in Europe due to MiCA rules

[ad_1] Kraken could drop EU support for Tether’s USDT stablecoin, Bloomberg reported on May 17. Kraken Global Head of Regulatory Strategy Marcus Hughes said the company is planning for circumstances in which it is “not tenable to list specific tokens such as USDT.” The EU’s regulatory landscape is set to change when the EU’s Markets…