Category: Latest news

-

US Treasury to increase focus on combatting illicit financial activity via crypto, emerging tech

[ad_1] The US Treasury Department intends to place a significant emphasis on addressing the risks posed by cryptocurrencies and other emerging technologies in the coming months via comprehensive regulation. The Treasury has made digital assets a key area of focus in its 2024 National Strategy for Combating Terrorist and Other Illicit Financing report. The strategy…

-

Understanding Bitcoin UTXO management and its impact on transaction efficiency and privacy

[ad_1] Bitcoin’s design contains a unique way of handling transactions through the Unspent Transaction Output (UTXO) model. While this model provides enhanced security and privacy compared to traditional account-based systems, it also presents challenges in efficiently managing one’s Bitcoin holdings. This article delves into the concept of UTXO management, its importance, and strategies to optimize…

-

Derivatives saw spike in Open Interest and volume as Bitcoin broke $66k

[ad_1] Bitcoin regained the $66,000 level in the night between May 15 and May 16, recovering some of the losses it incurred in the past week. This spike substantially impacted the derivatives market, significantly influencing both open interest and trading volume. Futures open interest, which indicates the total value of outstanding futures contracts yet to be…

-

Tornado Cash developer challenges conviction in Dutch court

[ad_1] Tornado Cash developer Alexey Pertsev has reportedly filed an appeal with the Dutch s-Hertogenbosch Court of Appeal following his recent conviction on money laundering charges. The appeal follows Pertsev’s May 14 sentencing to a 64-month prison term by a Dutch court. The court found him guilty of laundering approximately $1.2 billion through the Tornado…

-

Vanguard’s new CEO upholds firm’s stance against Bitcoin ETFs despite crypto enthusiasm

[ad_1] Mining for the future: Bitcoin industry trends in the aftermath of the halving Andjela Radmilac · 3 days ago CryptoSlate’s latest market report dives deep into the Hashrate Index Q1 report to determine the current state and future trajectory of Bitcoin mining. [ad_2] Source link

-

Boosting female leadership in crypto through quotas and proactive networking discussed in London

[ad_1] On April 24, the ‘Women in Crypto for Boards‘ series in London brought together C-level and Board-level women from the digital asset industry to address the underrepresentation of women in Web3, showcasing both the challenges and the opportunities for advancing gender equality in this rapidly evolving field. The event’s founder, Tim Connolly, highlighted the…

-

MakerDAO’s dual stablecoin solution promises to resolve longstanding trilemma

[ad_1] Rune Christensen, the founder of MakerDAO, has proposed a novel solution to the Stablecoin Trilemma. This trilemma posits that achieving a stable value pegged to the dollar, maintaining decentralization, and scaling to meet demand are mutually exclusive goals. Christensen’s solution involves a dual stablecoin framework, envisioning the evolution of Maker’s DAI stablecoin into two…

-

CME gears up to launch spot Bitcoin trading, challenging Binance’s dominance

[ad_1] The Chicago Mercantile Exchange (CME) is gearing up to introduce spot Bitcoin trading, responding to the growing demand for the leading digital asset on Wall Street, the Financial Times reported on May 16. CME is the world’s largest futures BTC trading medium and has been in talks with crypto traders to establish a regulated…

-

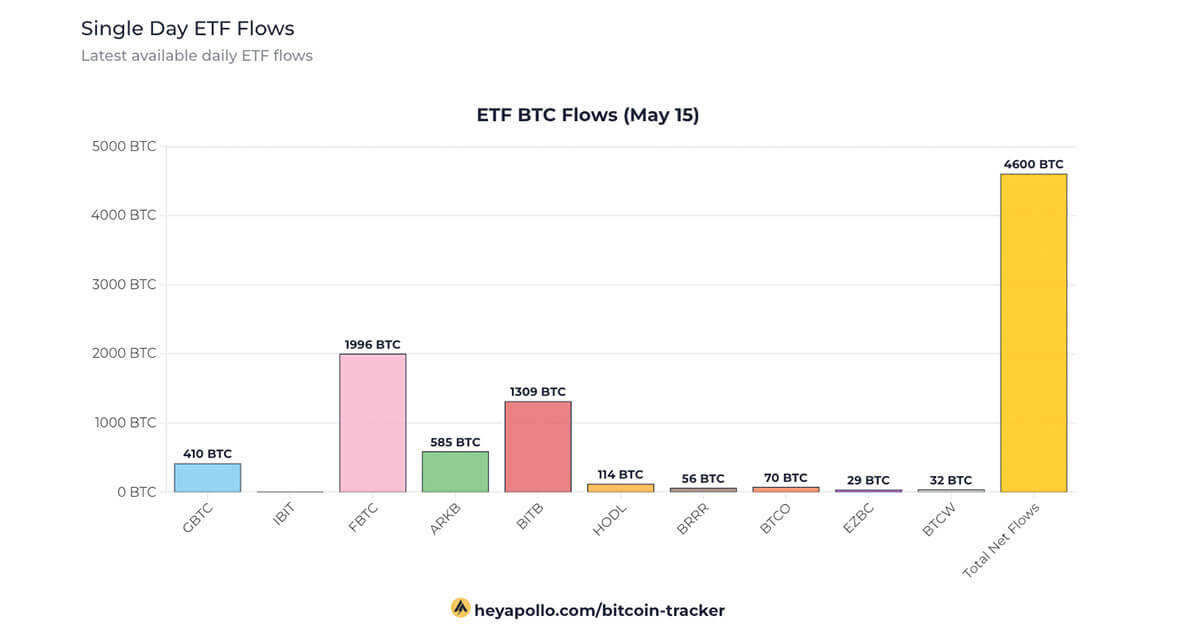

Grayscale GBTC registers rare inflow amid $303 million Bitcoin ETF surge

[ad_1] Mining for the future: Bitcoin industry trends in the aftermath of the halving Andjela Radmilac · 3 days ago CryptoSlate’s latest market report dives deep into the Hashrate Index Q1 report to determine the current state and future trajectory of Bitcoin mining. [ad_2] Source link

-

Two major hedge funds reveal $2.4 billion exposure to spot Bitcoin ETFs

[ad_1] Millennium Management and Schonfeld Strategic Advisors disclosed some of the largest spot Bitcoin ETF investments among traditional financial firms to date, according to their 13F filings for the first quarter. Millennium invested a total of $1.9 billion in spot Bitcoin ETFs, comprised of $844.2 million in BlackRock’s IBIT, $806.7 million in Fidelity’s FBTC, $202…