Category: Latest news

-

Bitcoin network celebrates 1 billion transactions as a Satoshi-era wallet awakens

[ad_1] Bitcoin network processed its one billionth transaction 15 years after it mined its genesis block in January 2009. Notably, the network achieved this milestone the same day a Satoshi-era Bitcoin address came to life. 1 billion transactions According to data from the Bitcoin dashboard on Clark Moody, the network processed its one billionth transaction…

-

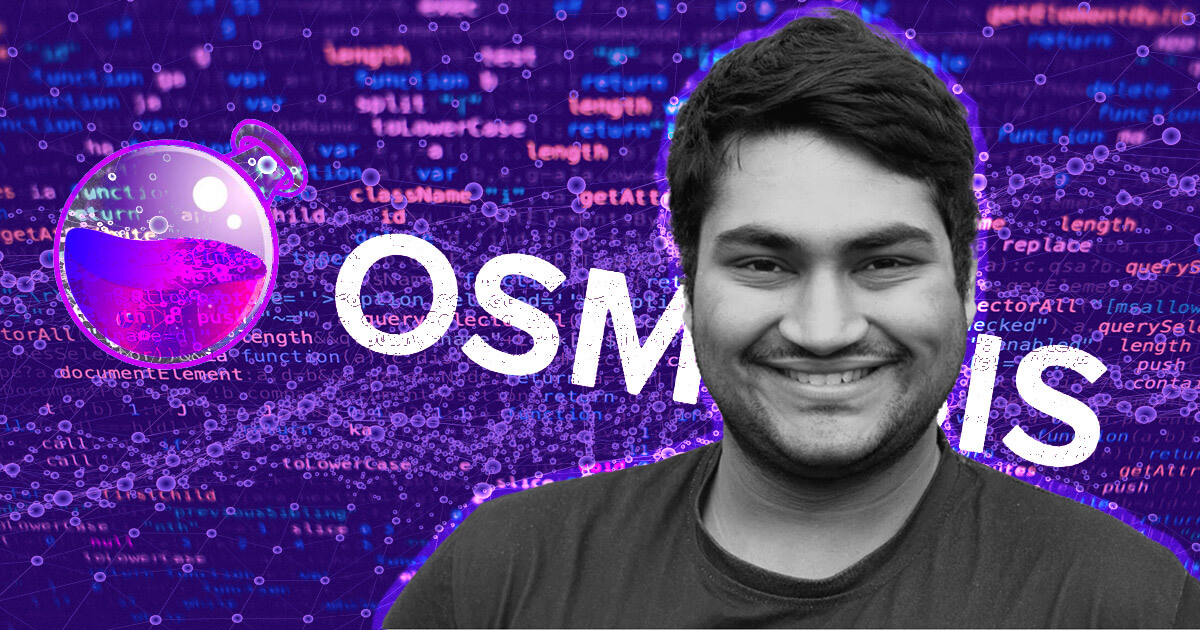

Osmosis co-founder Sunny Aggarwal on costumes, Cosmos, and the ‘Bitcoin renaissance’

[ad_1] Even if you’re not an avid ‘Cosmonaut,’ you’re probably familiar with Sunny Aggarwal, the co-founder of Osmosis Labs. With an infectious smile and upbeat personality, Sunny’s name is surprisingly apt. He’s the type of person whose deep intellect, quick wit, and unbridled passion light up the spaces around him. We were scheduled to meet…

-

Six Coinbase customers claim the exchange is violating securities laws in new lawsuit

[ad_1] Six Coinbase customers filed a new class-action lawsuit against crypto exchange Coinbase Global, two subsidiaries — Coinbase, Inc. and Coinbase Asset Management, LLC. — and its CEO, Brian Armstrong, on May 5. The lawsuit alleges that the digital assets listed on Coinbase are securities. This includes Solana (SOL), Polygon (MATIC), Near Protocol (NEAR), Decentraland…

-

BTC-e crypto exchange operator pleads guilty to money laundering in the U.S.

[ad_1] Alexander Vinnik, a Russian national who operated the crypto exchange BTC-e, pled guilty to charges of money laundering conspiracy in the US on May 3, according to a Bloomberg report. BTC-e was one of the world’s largest crypto exchanges between 2011 and 2017. According to the prosecutors, it processed transactions worth $9 billion and…

-

The rise of Bitcoin ETFs and future market implications

[ad_1] The following is a guest post from Shane Neagle. Regardless of an asset’s fundamentals, its value is governed by one underlying feature – market liquidity. Is it easy for the wider public to sell or buy this asset? If the answer is yes, then the asset receives high trading volume. When that happens, executing…

-

DOJ charges three Cred execs over $783 million in customer fund losses

[ad_1] On May 3, the US DOJ announced charges against former executives of Cred, a bankrupt crypto lending and investing firm. Authorities alleged that the three accused individuals — Cred co-owner and former CEO Daniel Schatt, former CFO Joseph Podulka, and former CCO James Alexander — took part in a scheme that caused customers to…

-

Nigeria poised to outlaw P2P crypto trading over national security concerns

[ad_1] Nigeria’s National Security Adviser (NSA) is set to label crypto trading as a national security threat, signaling an impending crackdown on peer-to-peer (P2P) crypto transactions, according to local media reports and CryptoSlate sources. The move follows the decision of at least three major Nigerian fintech startups — Moniepoint, Paga, and Palmpay — to block…

-

SEC under Trump would ‘vigorously pursue’ crypto regulation – former regulator says

[ad_1] Former SEC Division of Enforcement Assistant Director Jennifer Lee said on May 2 that Donald Trump’s possible reelection likely won’t change the SEC’s stance on crypto. Lee told CNBC the SEC “vigorously pursued crypto cases” during Trump’s first presidential term and that it brought “daylight and regulation” to the burgeoning industry. She predicted that…

-

Bitfinex whales bolster Bitcoin holdings by 6% amid recent price surge

[ad_1] Quick Take Over the past few days, Bitfinex has recorded a substantial 6% increase in Bitcoin (BTC) long positions held by whales — totaling a staggering 48,615 BTC. BTCUSD Longs: Bitfinex: (Source: TradingView) Analyzing Bitfinex whale activity in 2024 reveals a clear pattern: On Feb. 10, these whales held over 76,000 BTC, but by…

-

Crypto firms raised $2.5 billion in Q1, representing 29% quarterly increase

[ad_1] Galaxy reported an assortment of VC investment data, including nearly $2.5 billion invested in the first quarter, on May 3. Crypto firms attracted funding across 603 deals during the period, representing 29% growth in dollar value and 68% growth in deal count quarter-over-quarter. The growth represents the first increase by both measures in three…