Category: Latest news

-

Terraform Labs to restrict US access, withdraw $23 million of liquidity following SEC ruling

[ad_1] Terraform Labs (TFL) announced changes to its operations on April 25 in light of a recent court ruling related to the SEC’s case against the company. TFL said it expects to receive a conduct injunction soon that will bar it from certain activities in the US. The company added that it will prepare for…

-

Top Ethereum Layer-2 networks adopt Avail DA to boost rollup efficiency and security

[ad_1] Several top Ethereum Layer-2 (L2) networks, such as Arbitrum, Optimism, Polygon, zkSync, and Starkware, are preparing to integrate Avail’s Data Availability (DA) solution, according to an April 25 statement shared with CryptoSlate. This integration will grant rollup builders access to Avail DA and its ecosystem, facilitating the development of scalable and efficient rollup architectures…

-

Consensys sues SEC, seeks court declaration that Ethereum is not a security

[ad_1] Consensys filed a lawsuit against the US Securities and Exchange Commission (SEC) on April 25 over allegations that the watchdog has overstepped in its authority in trying to regulate Ethereum (ETH). The lawsuit alleges that the SEC aims to unlawfully regulate Ethereum through enforcement actions against various companies, including Consensys, constituting “aggressive and unlawful” overreach. Consensys…

-

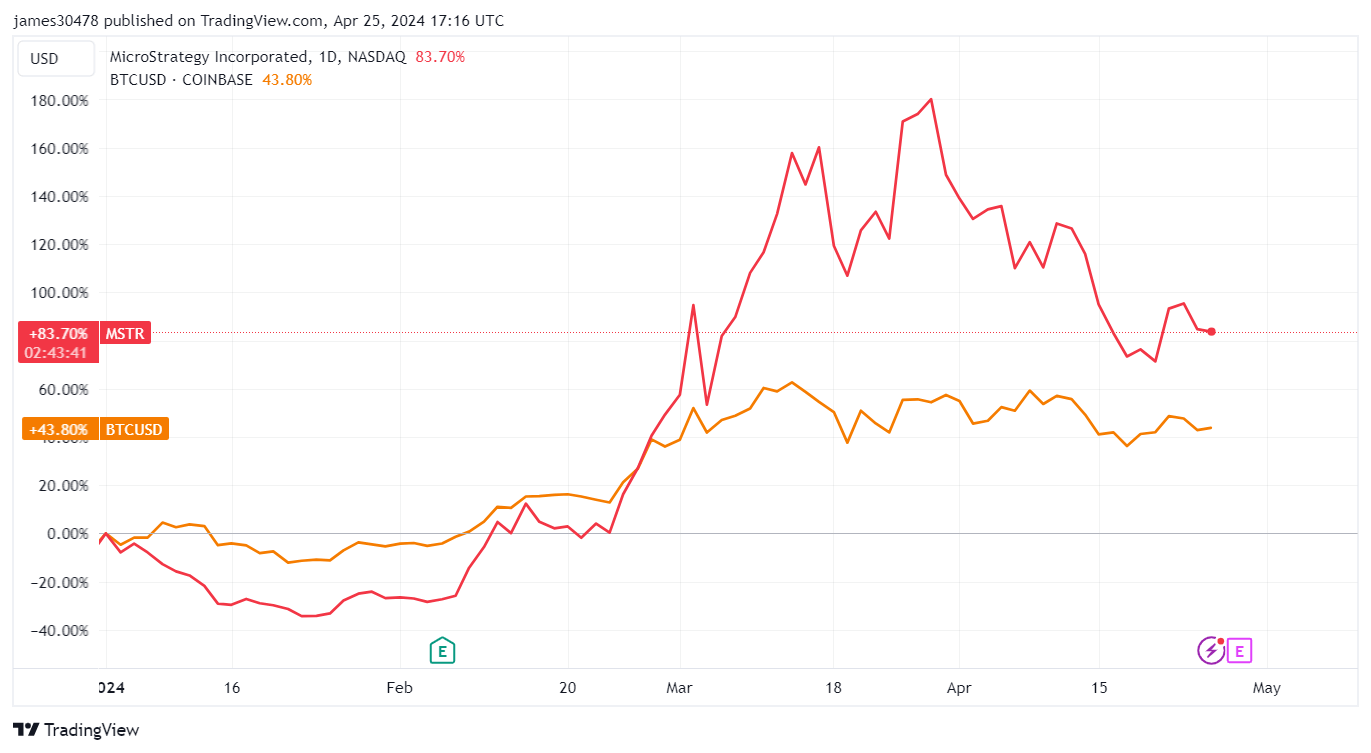

Despite market volatility, MicroStrategy’s “BTC per Share” reaches near record levels

[ad_1] Quick Take MicroStrategy (MSTR) has recently experienced a pullback in its stock price, currently trading around $1,260 per share, down 35% from its recent high of nearly $2,000. This decline is in line with Bitcoin’s (BTC) 8% pullback over the same period. Despite the recent downturn, MicroStrategy’s stock has outperformed Bitcoin year-to-date — with…

-

IBIT vs GLD: A compelling tale of Bitcoin’s growing dominance over traditional gold investments

[ad_1] Quick Take Bitcoin left a significant mark on the ETF industry in 2024, with Bitcoin ETFs drawing in more than $12 billion in net inflows combined. Leading this surge is BlackRock’s iShares Bitcoin ETF (IBIT), which has accumulated over $15 billion in net inflows and stands at the forefront of this success narrative. Recently,…

-

Bitcoin ETFs in the US drive higher crypto allocations among institutional investors

[ad_1] Institutional investors increasingly sought exposure to crypto during the first quarter of the year following the launch of several US-based spot Bitcoin exchange-traded funds (ETFs) in January. The CoinShares Digital Fund Manager survey revealed that these institutional investors have significantly increased their digital asset allocations, reaching 3% in their portfolios. This marks the highest…

-

Polygon leads in EVM efficiency as DeFi users favor low transaction costs

[ad_1] Layer-1 blockchains are foundational networks supporting various applications directly on their protocol, while Layer-2 blockchains operate atop these foundational layers, enhancing scalability and efficiency. Comparing the usage and efficiency of EVM-compatible L1 and L2 blockchains and side chains helps us better understand the market values and where most of the DeFi activity comes from.…

-

Bitcoin stabilizes near $63,000 as U.S. economic growth decelerates.

[ad_1] Quick Take Data from Trading Economics shows the United States economy grew at an annualized rate of 1.6% in the first quarter of 2024, falling short of the forecasted 2.5% and slowing down from the previous quarter’s 3.4% growth. Despite the slower pace, the economy continues to expand in an already overheated environment, with…

-

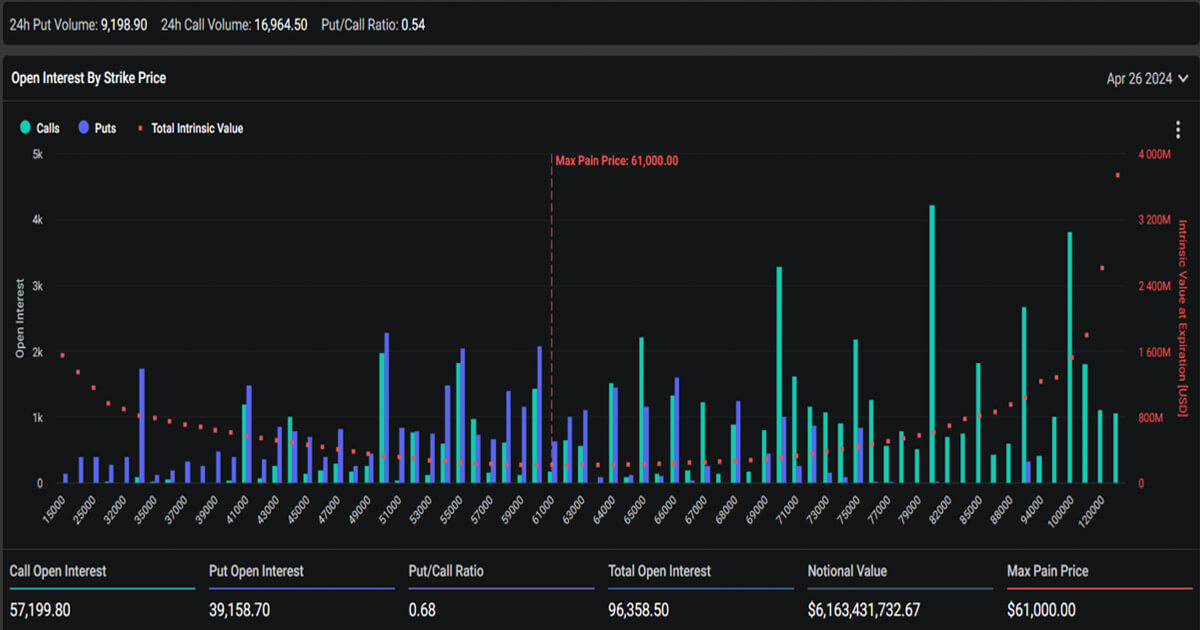

Bitcoin options signal cooling bullish sentiment as key support level emerges at $61,000

[ad_1] Quick Take As Bitcoin’s price hovers around $63,000, slightly down over the past 24 hours, the options market is providing insights into shifting investor sentiment ahead of the expiration on April 26. A key development has been the reduction in positive gamma exposure as Bitcoin declined through the heavily traded $65,000 call strike. According…

-

Europe tightens crypto regulations with new anti-money laundering laws

[ad_1] Crypto Asset Service Providers (CASP) in Europe would have to implement stringent Know Your Customer (KYC) procedures to combat money laundering following the European Parliament greenlight of new Anti-Money Laundering Regulations (AMLR), according to an April 24 statement. According to the statement: “The new laws include enhanced due diligence measures and checks on customers’…