Category: Latest news

-

Bitcoin’s latest rally driven by ‘huge accumulation’

[ad_1] Bitcoin’s (BTC) latest rally was driven by “huge accumulation” as investor appetite remains high despite five days of trading in the red over the past week, according to CryptoQuant research. Just three days ago, Bitcoin was trading at roughly $65,500 as markets closed on Friday. However, a sustained rally over the weekend took prices…

-

Exploring Bitget: The world’s up-and-coming crypto exchange

[ad_1] Bitget is a rapidly growing cryptocurrency exchange registered in Seychelles that has become the world’s largest crypto copy trading platform. Established in 2018, Bitget now serves over 25 million registered users globally and boasts an impressive $10+ billion USDT daily trading volume. With a global team of over 1,300 employees from 60 countries, Bitget…

-

Nigerian court orders Binance executive to remain in prison despite not guilty plea

[ad_1] A Nigerian High Court in Abuja ordered that the detained Binance executive Tigran Gambaryan be remanded in prison following the postponement of his bail hearing. Gambaryan, a US citizen, pleaded not guilty to money laundering charges earlier today and will remain in custody until his bail hearing on April 18. The trial will commence…

-

Sora Ventures, Metaplanet bet $6.5 million on Bitcoin to create ‘Asia’s first MicroStrategy’

[ad_1] Metaplanet, a Tokyo Stock Exchange-listed company, announced on April 8 that it has embraced Bitcoin as a core treasury asset. In an April 8 statement on social media platform X (formerly Twitter), Metaplanet said it was allocating ¥1 billion, approximately $6.56 million, to the flagship digital asset as part of its groundbreaking shift in…

-

Top Chinese mutual funds exploring Bitcoin ETFs via Hong Kong units

[ad_1] Leading Chinese mutual funds are actively exploring Bitcoin exchange-traded funds (ETFs) through their subsidiaries in Hong Kong, with adoption set to kick off within the second quarter once regulatory approval is secured, local media reported on April 8. The move marks a significant pivot toward crypto investment among firms in the region, which have…

-

Investor fervor for Bitcoin ETFs cools despite $646 million weekly surge in crypto funds

[ad_1] Crypto-related investment products continued their upward trajectory, recording inflows of $646 million within the past week, according to CoinShares‘ weekly report. This inflow brings the total for the year to an unprecedented $13.8 billion, propelling the total assets under management to a staggering $94.47 billion. Bitcoin ETF hype moderating Trading volume for crypto investment…

-

Ethena’s USDe Bitcoin collateral exceeds $500 million in a week

[ad_1] Bitcoin collateral for Ethena’s USDe synthetic dollar has exceeded $500 million less than a week after its introduction. The platform’s website data showed approximately $537 million in Bitcoin reserves across various exchanges such as Binance, OKX, and Deribit. The amount represents roughly 26% of its total asset reserve. The other reserve assets include $714…

-

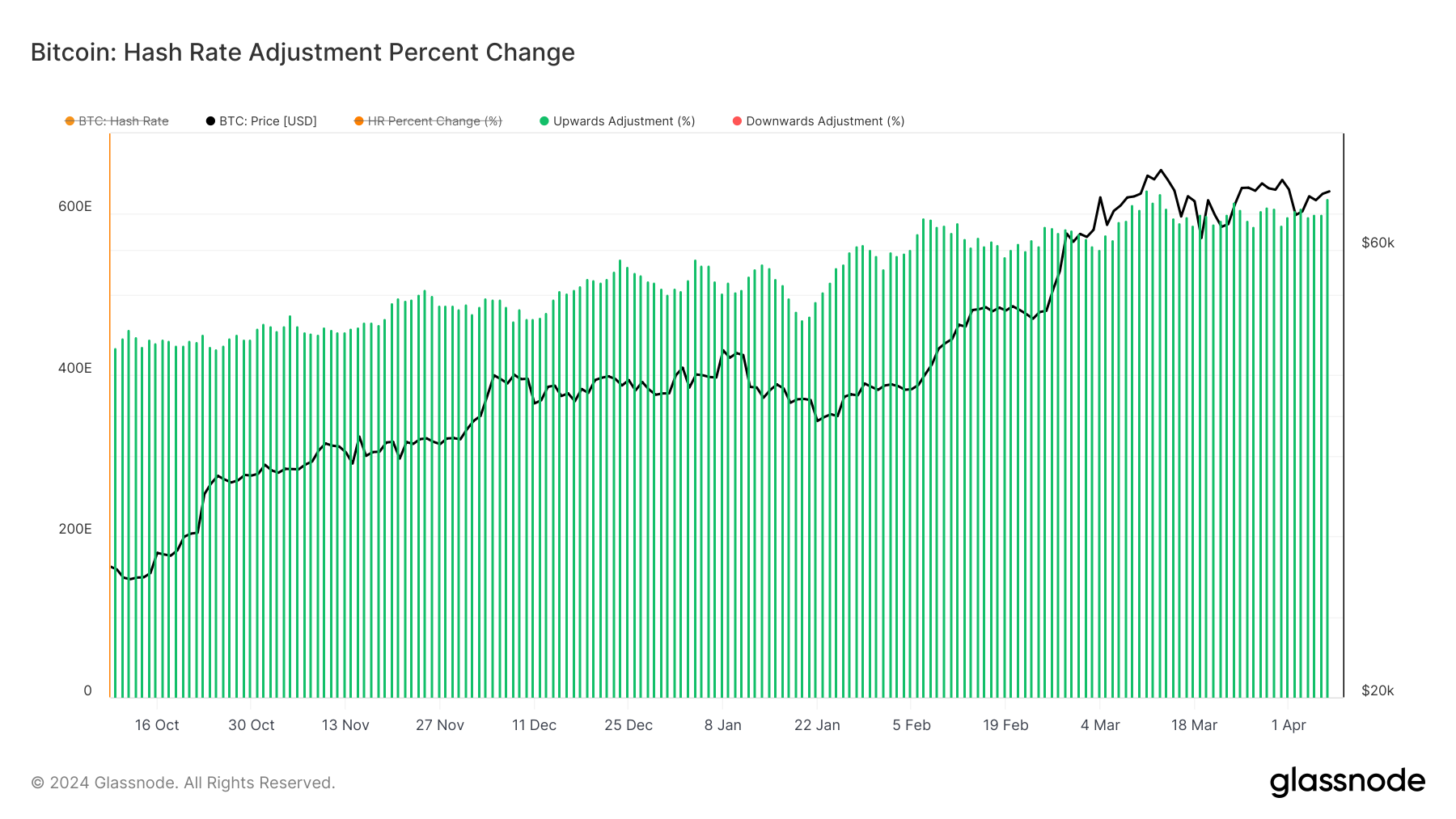

Marathon CEO hints at sovereign contributions to Bitcoin’s burgeoning hash rate

[ad_1] Quick Take The Bitcoin network is experiencing a remarkable surge in its hash rate, a crucial metric that reflects the computing power dedicated to processing transactions and maintaining the blockchain. According to the latest Glassnode data, the 7-day moving average hash rate has reached an astonishing 620 EH/s, nearing all-time highs. Hash Rate: (Source:…

-

Runes Liquid Fund launches with $3 million investment as halving nears

[ad_1] Sora Ventures, a venture capital firm focused on the Bitcoin ecosystem, has announced the successful raise of $3 million to launch a Runes Liquid Fund, a new investment vehicle dedicated to investing in liquid assets on the Runes Protocol. Investors include Bankless Ventures, SpaceshipDAO, entities from BTC Inc. Bitcoin Magazine, and Serafund. Runes refers…

-

Rivalries among Ethereum layer-2s threaten the ecosystem’s future, says Polygon CEO

[ad_1] Polygon Labs CEO Marc Boiron believes that the intense rivalry between Ethereum layer-2 networks is the “biggest problem” facing the second-largest digital asset by market capitalization. In an April 7 post on social media platform X, Boiron emphasized how the competition between these networks has led to Ethereum cannibalizing itself continuously. He explained: “Ethereum’s…